Page 50 - Lake Worth Adopted Budget FY 23-24

P. 50

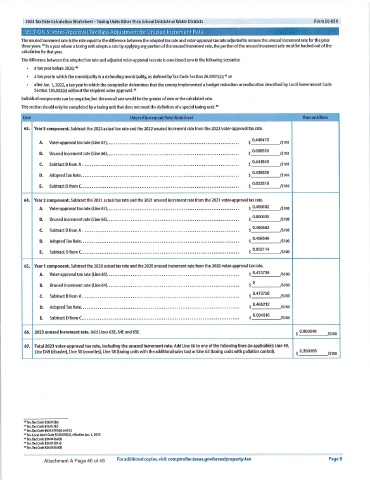

2023 Tax Rate Calculation Worksheet—Taxing Units Other Than School Districts or Water Districts Form 50- 856

SECTION 5: Vote r-,Approva I Tax Rate Adjustment for Unused Increment Rate

The unused increment rate is the rate equal to the difference between the adopted tax rate and voter -approval tax rate adjusted to remove the unused increment rate for the prior

three years. 39 In a year where a taxing unit adopts a rate by applying any portion ofthe unused increment rate, the portion ofthe unused increment rate must be backed out ofthe

calculation for that year.

The difference between the adopted tax rate and adjusted voter -approval tax rate is considered zero in the following scenarios:

a tax year before 2020;' 0

a tax year in which the municipality is a defunding municipality, as defined by Tax Code Section 26.0501 (a); 11 or

after Jan. 1, 2022, a tax year in which the comptroller determines that the county implemented a budget reduction or reallocation described by Local Government Code

Section 120.002(a) without the required voter approval."

Individual components can be negative, but the overall rate would be the greater ofzero or the calculated rate.

This section should only be completed by a taxing unit that does not meet the definition of a special taxing unit."

Line U s- re a to e s eet_ A

63. Year 3 component. Subtract the 2022 actual tax rate and the 2022 unused Increment rate from the 2022 voter -approval tax rate.

0.448476

A. Voter -a Pp ()................................................................... 100

rovaltax rate Line 67

00006630

Be Unused increment rate (Line 66)................................ 100

0.441846

C. Subtract B from A . 100

0.438928

D. Adopted Tax Rate. 100

0.002918

E. Subtract D from C.. sea seem .. ago sod ........... eve ..................................................... 100

64. Year 2 component. Subtract the 2021 actual tax rate and the 2021 unused increment rate from the 2021 voter -approval tax rate.

0.460662

A. Voter -approval tax rate (Line 67)....................................................................... m 100

00000000

Be Unused increment rate (Line 66)........................................................................ 100

460662 100

0.

C. Subtract Bfrom A. D.

458548 100

Adopted Tax Rate. 0. E.

002114 too

Subtract D from Co. a a 6 6 a a 0 a 6 0 0 & A a 0 a a 4 a 0 0 0 0 0 4 6 a 4 6 0 0 0 a a 0 0 0 6 a a a 6 6 a 0 0 4 6 4 0 0 0 s 0 0 0 0 6 0 a M a 4 a 9 0 * a 6 & a a 0 a 0 a 9 0 0 6 0 a 0 0. 65,

Year 1 component. Subtract the 2020 actual tax rate and the 2020 unused increment rate from the 2020 voter -approval tax rate. A.

s

Voter - approval taxrate (Line 65)........................................................................ 0. 473728 100 B.

100

s

Unused increment rate (Line 64)....................................................................... 0 C,

473728 100

0.

Subtract B from A . D,

469212 100

AdoptedTaxRate. 0. E.

100 66.

004516

0.

Subtract D from C...................................................................................... 2023

unused increment rate. Add Lines 63E, 64E and 65E. 04009548 /$100 67,

Total

2023 voter -approval tax rate, including the unused increment rate. Add Line 66 to one of the following lines (as applicable): Line 49, Line D49 (

disaster), Line 50 (counties), Line 58 (taxing units with the additional sales tax) or Line 62 (taxing units with pollution control). 09390105 /$100 Tex. Tax

Code 426.013(a) Tex. Tax

Code 426.013(c) Tex.Tax

Code 4426.0501(a) and (c) Tex. Local

2022

Tex.

Jan.

Gov' t Code 4120. 007(d), 1, Tax

effective

Code 426.063(a)(1) Tax

Tex.

S

Code 426.012(8-a) Tex.

Attachment

Tax Code 426.063(a)(1) A

Page 46 of 48 For additional copies, visit: comptroller. texas. gov/taxes/property- tax Page 8