Page 22 - KennedaleFY24AdoptedBudget

P. 22

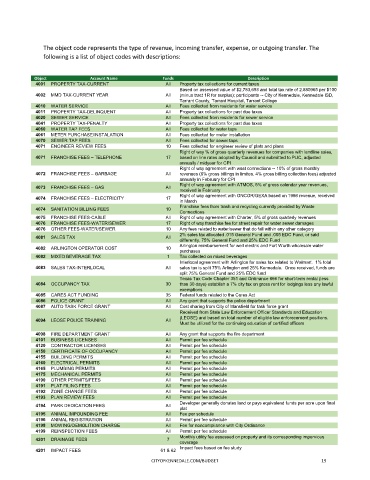

The object code represents the type of revenue, incoming transfer, expense, or outgoing transfer. The

following is a list of object codes with descriptions:

Object Account Name Funds Description

4001 PROPERTY TAX-CURRENT All Property tax collections for current taxes

Based on assessed value of $2,783,693 and total tax rate of 2.880965 per $100

4002 MMD TAX-CURRENT YEAR All (minus tract 1R for surplus); participants -- City of Kennedale, Kennedale ISD,

Tarrant County, Tarrant Hospital, Tarrant College

4010 WATER SERVICE All Fees collected from residents for water service

4011 PROPERTY TAX-DELINQUENT All Property tax collections for past due taxes

4020 SEWER SERVICE All Fees collected from residents for sewer service

4041 PROPERTY TAX-PENALTY All Property tax collections for past due taxes

4060 WATER TAP FEES All Fees collected for water taps

4061 METER PURCHASE/INSTALATION All Fees collected for meter installation

4070 SEWER TAP FEES All Fees collected for sewer taps

4071 ENGINEER REVIEW FEES 10 Fees collected for engineer review of plats and plans

Right of way % of gross quarterly revenues for companies with landline sales,

4071 FRANCHISE FEES – TELEPHONE 17 based on line rates adopted by Council and submitted to PUC, adjusted

annually / midyear for CPI

Right of way agreement with wast connections -- 10% of gross monthly

4072 FRANCHISE FEES – GARBAGE All revenues (6% gross billings in limites, 4% gross billing collection fees) adjusted

annually in February for CPI

Right of way agreement with ATMOS, 5% of gross calendar year revenues,

4073 FRANCHISE FEES – GAS All

received in February

Right of way agreement with ONCOR/GEXA based on 1998 revenue, received

4074 FRANCHISE FEES – ELECTRICITY 17

in March

Franchise fees from trash and recycling currently provided by Waste

4074 SANITATION BILLING FEES 10

Connections

4075 FRANCHISE FEES-CABLE All Right of way agreement with Charter, 5% of gross quarterly revenues

4076 FRANCHISE FEES-WATER/SEWER 17 Right of way franchise fee for street repair for water sewer damages

4076 OTHER FEES-WATER/SEWER 10 Any fees related to water/sewer that do fall within any other category

4081 SALES TAX All 2% sales tax allocated .015 General Fund and .005 EDC Fund, or said

differently, 75% General Fund and 25% EDC Fund

4082 ARLINGTON OPERATOR COST 10 Arlington reimbursement for well electric and Fort Worth wholesale water

purchases

4082 MIXED BEVERAGE TAX 1 Tax collected on mixed beverages

Interlocal agreement with Arlington for sales tax related to Walmart. 1% total

4083 SALES TAX-INTERLOCAL All sales tax is split 75% Arlington and 25% Kennedale. Once received, funds are

split 75% General Fund and 25% EDC fund

Texas Tax Code Chapter 351 and Ordinance 666 for short-term rental (less

4084 OCCUPANCY TAX 30 than 30 days) establish a 7% city tax on gross rent for lodgings less any lawful

exemptions

4085 CARES ACT FUNDING 35 Federal funds related to the Cares Act

4086 POLICE GRANT All Any grant that supports the police department

4087 AUTO TASK FORCE GRANT All Cost sharing from City of Mansfield for task force grant

Received from State Law Enforcement Officer Standards and Education

4094 LEOSE POLICE TRAINING All (LEOSE) and based on total number of eligible law enforecement positions.

Must be utilized for the continuing education of certified officers

4098 FIRE DEPARTMENT GRANT All Any grant that supports the fire department

4101 BUSINESS LICENSES All Permit per fee schedule

4120 CONTRACTOR LICENSES All Permit per fee schedule

4150 CERTIFICATE OF OCCUPANCY All Permit per fee schedule

4155 BUILDING PERMITS All Permit per fee schedule

4160 ELECTRICAL PERMITS All Permit per fee schedule

4165 PLUMBING PERMITS All Permit per fee schedule

4175 MECHANICAL PERMITS All Permit per fee schedule

4190 OTHER PERMITS/FEES All Permit per fee schedule

4191 PLAT FILING FEES All Permit per fee schedule

4192 ZONE CHANGE FEES All Permit per fee schedule

4193 PLAN REVIEW FEES All Permit per fee schedule

Developer generally donates land or pays equivalend funds per acre upon final

4194 PARK DEDICATION FEES All

plat

4195 ANIMAL IMPOUNDING FEE All Fee per schedule

4196 ANIMAL REGISTRATION All Permit per fee schedule

4198 MOWING/DEMOLITION CHARGE All Fee for noncompliance with City Ordinance

4199 REINSPECTION FEES All Permit per fee schedule

Monthly utility fee assessed on property and its corresponding impervious

4201 DRAINAGE FEES 7

coverage

Impact fees based on fee study

4201 IMPACT FEES 61 & 62

CITYOFKENNEDALE.COM/BUDGET 19