Page 84 - FY 24 Budget Forecast at Adoption.xlsx

P. 84

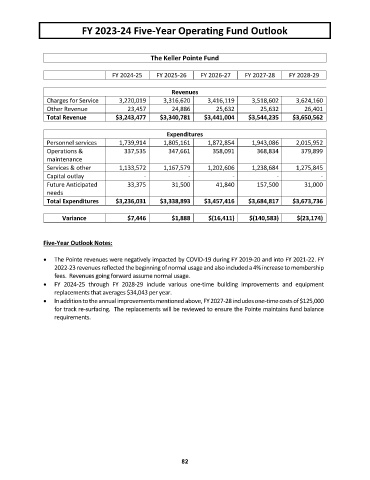

FY 2023-24 Five-Year Operating Fund Outlook

The Keller Pointe Fund

FY 2024-25 FY 2025-26 FY 2026-27 FY 2027-28 FY 2028-29

Revenues

Charges for Service 3,220,019 3,316,620 3,416,119 3,518,602 3,624,160

Other Revenue 23,457 24,886 25,632 25,632 26,401

Total Revenue $3,243,477 $3,340,781 $3,441,004 $3,544,235 $3,650,562

Expenditures

Personnel services 1,739,914 1,805,161 1,872,854 1,943,086 2,015,952

Operations & 337,535 347,661 358,091 368,834 379,899

maintenance

Services & other 1,133,572 1,167,579 1,202,606 1,238,684 1,275,845

Capital outlay - - - - -

Future Anticipated 33,375 31,500 41,840 157,500 31,000

needs

Total Expenditures $3,236,031 $3,338,893 $3,457,416 $3,684,817 $3,673,736

Variance $7,446 $1,888 $(16,411) $(140,583) $(23,174)

Five-Year Outlook Notes:

The Pointe revenues were negatively impacted by COVID-19 during FY 2019-20 and into FY 2021-22. FY

2022-23 revenues reflected the beginning of normal usage and also included a 4% increase to membership

fees. Revenues going forward assume normal usage.

FY 2024-25 through FY 2028-29 include various one-time building improvements and equipment

replacements that averages $34,043 per year.

In addition to the annual improvements mentioned above, FY 2027-28 includes one-time costs of $125,000

for track re-surfacing. The replacements will be reviewed to ensure the Pointe maintains fund balance

requirements.

82