Page 80 - FY 24 Budget Forecast at Adoption.xlsx

P. 80

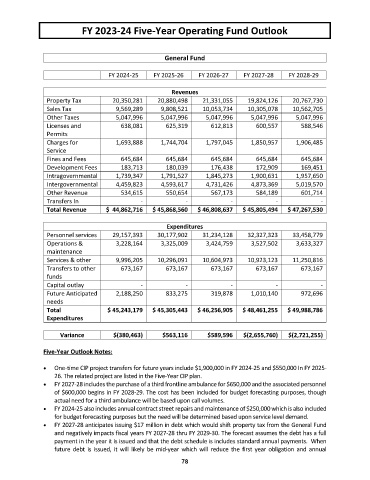

FY 2023-24 Five-Year Operating Fund Outlook

General Fund

FY 2024-25 FY 2025-26 FY 2026-27 FY 2027-28 FY 2028-29

Revenues

Property Tax 20,350,281 20,880,498 21,331,055 19,824,126 20,767,730

Sales Tax 9,569,289 9,808,521 10,053,734 10,305,078 10,562,705

Other Taxes 5,047,996 5,047,996 5,047,996 5,047,996 5,047,996

Licenses and 638,081 625,319 612,813 600,557 588,546

Permits

Charges for 1,693,888 1,744,704 1,797,045 1,850,957 1,906,485

Service

Fines and Fees 645,684 645,684 645,684 645,684 645,684

Development Fees 183,713 180,039 176,438 172,909 169,451

Intragovernmental 1,739,347 1,791,527 1,845,273 1,900,631 1,957,650

Intergovernmental 4,459,823 4,593,617 4,731,426 4,873,369 5,019,570

Other Revenue 534,615 550,654 567,173 584,189 601,714

Transfers In - - - - -

Total Revenue $ 44,862,716 $ 45,868,560 $ 46,808,637 $ 45,805,494 $ 47,267,530

Expenditures

Personnel services 29,157,393 30,177,902 31,234,128 32,327,323 33,458,779

Operations & 3,228,164 3,325,009 3,424,759 3,527,502 3,633,327

maintenance

Services & other 9,996,205 10,296,091 10,604,973 10,923,123 11,250,816

Transfers to other 673,167 673,167 673,167 673,167 673,167

funds

Capital outlay - - - - -

Future Anticipated 2,188,250 833,275 319,878 1,010,140 972,696

needs

Total $ 45,243,179 $ 45,305,443 $ 46,256,905 $ 48,461,255 $ 49,988,786

Expenditures

Variance $(380,463) $563,116 $589,596 $(2,655,760) $(2,721,255)

Five-Year Outlook Notes:

One-time CIP project transfers for future years include $1,900,000 in FY 2024-25 and $550,000 In FY 2025-

26. The related project are listed in the Five-Year CIP plan.

FY 2027-28 includes the purchase of a third frontline ambulance for $650,000 and the associated personnel

of $600,000 begins in FY 2028-29. The cost has been included for budget forecasting purposes, though

actual need for a third ambulance will be based upon call volumes.

FY 2024-25 also includes annual contract street repairs and maintenance of $250,000 which is also included

for budget forecasting purposes but the need will be determined based upon service level demand.

FY 2027-28 anticipates issuing $17 million in debt which would shift property tax from the General Fund

and negatively impacts fiscal years FY 2027-28 thru FY 2029-30. The forecast assumes the debt has a full

payment in the year it is issued and that the debt schedule is includes standard annual payments. When

future debt is issued, it will likely be mid-year which will reduce the first year obligation and annual

78