Page 74 - FY 24 Budget Forecast at Adoption.xlsx

P. 74

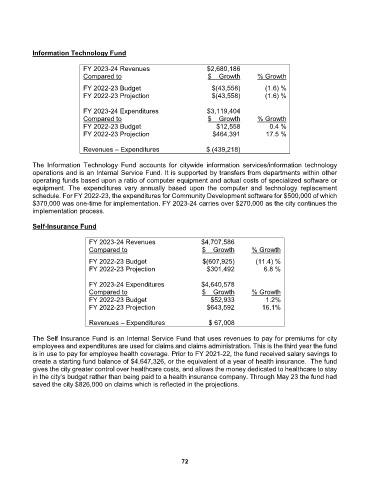

Information Technology Fund

FY 2023-24 Revenues $2,680,186

Compared to $ Growth % Growth

FY 2022-23 Budget $(43,558) (1.6) %

FY 2022-23 Projection $(43,558) (1.6) %

FY 2023-24 Expenditures $3,119,404

Compared to $ Growth % Growth

FY 2022-23 Budget $12,558 0.4 %

FY 2022-23 Projection $464,391 17.5 %

Revenues – Expenditures $ (439,218)

The Information Technology Fund accounts for citywide information services/information technology

operations and is an Internal Service Fund. It is supported by transfers from departments within other

operating funds based upon a ratio of computer equipment and actual costs of specialized software or

equipment. The expenditures vary annually based upon the computer and technology replacement

schedule. For FY 2022-23, the expenditures for Community Development software for $500,000 of which

$370,000 was one-time for implementation. FY 2023-24 carries over $270,000 as the city continues the

implementation process.

Self-Insurance Fund

FY 2023-24 Revenues $4,707,586

Compared to $ Growth % Growth

FY 2022-23 Budget $(607,925) (11.4) %

FY 2022-23 Projection $301,492 6.8 %

FY 2023-24 Expenditures $4,640,578

Compared to $ Growth % Growth

FY 2022-23 Budget $52,933 1.2%

FY 2022-23 Projection $643,592 16.1%

Revenues – Expenditures $ 67,008

The Self Insurance Fund is an Internal Service Fund that uses revenues to pay for premiums for city

employees and expenditures are used for claims and claims administration. This is the third year the fund

is in use to pay for employee health coverage. Prior to FY 2021-22, the fund received salary savings to

create a starting fund balance of $4,647,326, or the equivalent of a year of health insurance. The fund

gives the city greater control over healthcare costs, and allows the money dedicated to healthcare to stay

in the city’s budget rather than being paid to a health insurance company. Through May 23 the fund had

saved the city $826,000 on claims which is reflected in the projections.

72