Page 73 - FY 24 Budget Forecast at Adoption.xlsx

P. 73

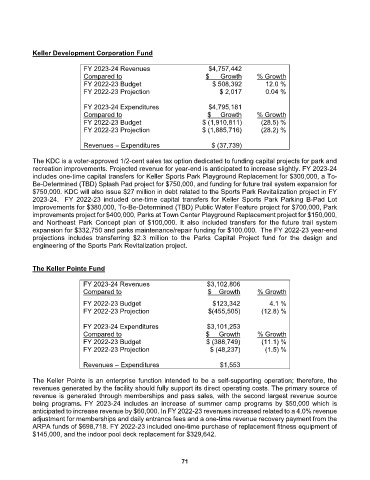

Keller Development Corporation Fund

FY 2023-24 Revenues $4,757,442

Compared to $ Growth % Growth

FY 2022-23 Budget $ 508,392 12.0 %

FY 2022-23 Projection $ 2,017 0.04 %

FY 2023-24 Expenditures $4,795,181

Compared to $ Growth % Growth

FY 2022-23 Budget $ (1,910,811) (28.5) %

FY 2022-23 Projection $ (1,885,716) (28.2) %

Revenues – Expenditures $ (37,739)

The KDC is a voter-approved 1/2-cent sales tax option dedicated to funding capital projects for park and

recreation improvements. Projected revenue for year-end is anticipated to increase slightly. FY 2023-24

includes one-time capital transfers for Keller Sports Park Playground Replacement for $300,000, a To-

Be-Determined (TBD) Splash Pad project for $750,000, and funding for future trail system expansion for

$750,000. KDC will also issue $27 million in debt related to the Sports Park Revitalization project in FY

2023‐24. FY 2022-23 included one-time capital transfers for Keller Sports Park Parking B-Pad Lot

Improvements for $380,000, To-Be-Determined (TBD) Public Water Feature project for $700,000, Park

improvements project for $400,000, Parks at Town Center Playground Replacement project for $150,000,

and Northeast Park Concept plan of $100,000. It also included transfers for the future trail system

expansion for $332,750 and parks maintenance/repair funding for $100,000. The FY 2022-23 year-end

projections includes transferring $2.3 million to the Parks Capital Project fund for the design and

engineering of the Sports Park Revitalization project.

The Keller Pointe Fund

FY 2023-24 Revenues $3,102,806

Compared to $ Growth % Growth

FY 2022-23 Budget $123,342 4.1 %

FY 2022-23 Projection $(455,505) (12.8) %

FY 2023-24 Expenditures $3,101,253

Compared to $ Growth % Growth

FY 2022-23 Budget $ (388,749) (11.1) %

FY 2022-23 Projection $ (48,237) (1.5) %

Revenues – Expenditures $1,553

The Keller Pointe is an enterprise function intended to be a self-supporting operation; therefore, the

revenues generated by the facility should fully support its direct operating costs. The primary source of

revenue is generated through memberships and pass sales, with the second largest revenue source

being programs. FY 2023-24 includes an increase of summer camp programs by $50,000 which is

anticipated to increase revenue by $60,000. In FY 2022-23 revenues increased related to a 4.0% revenue

adjustment for memberships and daily entrance fees and a one-time revenue recovery payment from the

ARPA funds of $698,718. FY 2022-23 included one-time purchase of replacement fitness equipment of

$145,000, and the indoor pool deck replacement for $329,642.

71