Page 98 - CityofHaltomFY24Budget

P. 98

City Of Haltom City Annual Budget, Fy2024 Debt Service Fund City Of Haltom City Annual Budget, Fy2024 Debt Service Fund

DEBT SERVICE FUND

Legal Debt Limit for General Obligation Debt BUDGET SUMMARY

Actual Adopted Projected Adopted

All taxable properties within the City is subject to the annual assessment, levy, and collection of FUND 05 FY2022 FY2023 FY2023 FY2024

ad valorem tax sufficient to provide for the principal and interest principal on City issued General

Obligation Bonds. Article XI, Section 5, of the Texas Constitution is applicable to the City, limiting Fund Balance, Beginning 1,708,498 1,906,605 1,906,605 2,494,713

the maximum ad valorem tax rate to $2.50 per $100 of assessed property valuation (for all City Revenues

purposes). Self-supporting debt that will be repaid by revenues generated through the ongoing Property Tax Revenue 7,166,425 7,214,306 7,214,306 7,151,428

activities in the enterprise funds or other non-governmental funds are not subject to the same legal Interest Income (185,288) 20,000 854,350 213,588

Transfer from General Fund

-

-

-

-

debt limit. Limits for self-supporting debt are instead set by the ability of the issuing entity’s city Transfer from Economic Dev. Fund - - - -

charter, profit and loss considerations, or other governing body lconstraints. Transfer from Oil and Gas 293,412 - - -

Proceeds from Bond Issuance 5,445,000 - - -

Premiums on Bond Issuance 781,295 - - -

Total Revenues 13,500,844 7,234,306 8,068,656 7,365,016

The City limits the total annual tax-supported debt service to no more than 25% of total spending. Funds Available 15,209,342 9,140,911 9,975,261 9,859,728

The property tax supported debt is the equivalent to 17% of total expenditures. The adopted debt

service budget of $9,307,309 includes $7,488,984 of debt supported by property taxes, $1,549,701 Expenditures

is supported by the Water & Sewer revenues, and $268,624 is supported by Drainage Fund Principal 5,510,000 4,530,000 4,530,000 4,685,000

1,696,307

2,945,549

2,786,984

2,945,549

Interest

revenues. For FY2024, the debt services portion of the tax rate is at $0.195452. Paying Agent Fees 3,046 5,000 5,000 17,000

Bond Issuance Cost 6,187 - - -

Refunded Escrow Bond Payments 4,397,197 - - -

Transfer to Water & Sewer Fund 1,690,000 - - -

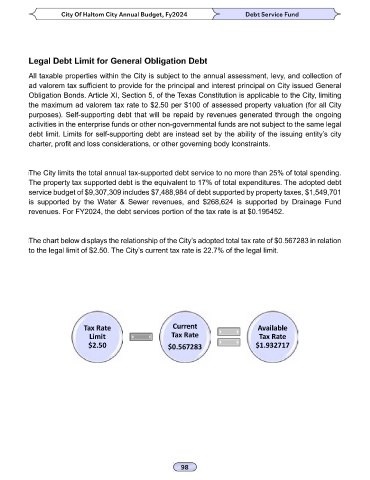

The chart below displays the relationship of the City’s adopted total tax rate of $0.567283 in relation Total Expenditures 13,302,737 7,480,549 7,480,549 7,488,984

to the legal limit of $2.50. The City’s current tax rate is 22.7% of the legal limit.

Fund Balance, Ending 1,906,605 1,660,362 2,494,713 2,370,744

Debt Service Fund Expenditures

$6

$5

$4

Millions $3

Tax Rate Current Available $2

Limit Tax Rate Tax Rate

$2.50 $0.567283 $1.932717 $1

$0

Principal Interest