Page 58 - CityofHaltomFY24Budget

P. 58

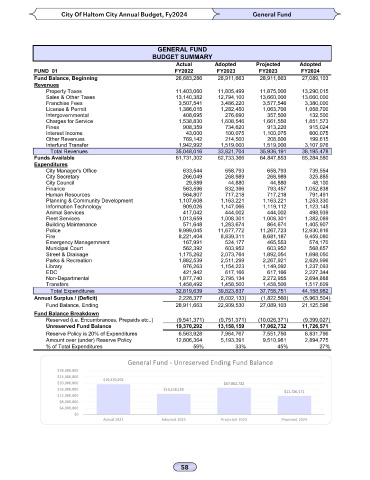

City Of Haltom City Annual Budget, Fy2024 General Fund City Of Haltom City Annual Budget, Fy2024 General Fund

OVERVIEW OF GENERAL FUND REVENUES

GENERAL FUND

BUDGET SUMMARY

Actual Adopted Projected Adopted Total General Fund Revenues for FY2024 Licenses & Permits is made up of building

FUND 01 FY2022 FY2023 FY2023 FY2024 are projected to increase about $2.3 million permits, licenses and permits for engineering,

Fund Balance, Beginning 26,683,286 28,911,663 28,911,663 27,089,103 or by 5.8%. electrical, plumbing, and mechanical

Revenues

Property Taxes 11,403,060 11,805,499 11,875,000 13,290,015 Property Tax is assessed on real and personal installations. Revenues for FY2024 are

Sales & Other Taxes 13,140,382 12,794,100 13,660,000 13,660,000 property and provides 35%, or $13.3 million, projected to remain consistent at $1.1 million

Franchise Fees 3,507,541 3,486,220 3,577,546 3,380,000 of the FY2024 revenues. The General Fund with fiscal 2023’s budget. However, with the

License & Permit 1,386,015 1,282,450 1,063,700 1,058,700

Intergovernmental 408,695 276,690 357,500 132,500 Property Tax revenue is higher in FY2024 due build out of new businesses, those fees could

Charges for Service 1,538,830 1,608,546 1,661,550 1,851,573 to increased assessed property values despite exceed projections.

Fines 908,359 734,620 913,220 915,024 the lowered tax rate by four cents per $100.

Interest Income 43,000 100,075 1,100,075 600,075 Charges for Services include recreation fees,

Other Revenues 769,142 214,500 208,600 199,615 Sales & Use Tax includes Mixed Beverage

Interfund Transfer 1,942,992 1,519,000 1,519,000 3,107,976 inspection fees, alarm fees and and other

Total Revenues 35,048,016 33,821,704 35,936,191 38,195,478 Taxes. Both taxes are collected by the State services provided. Revenues for FY2024 are

Funds Available 61,731,302 62,733,366 64,847,853 65,284,580 and forwarded to the City. The General Fund’s projected to grow by $1.8 million, or 11%, over

Expenditures portion of the City’s 2% Sales Tax is 1.375%.

City Manager's Office 633,544 658,793 658,793 739,554 last year.

City Secretary 266,049 268,989 268,989 325,885 The remaining portion goes to other restricted

City Council 29,589 44,880 44,880 48,100 funds. Sales and Use Taxes represents $13.7 Fines & Fees are court fines. Because of the

Finance 563,596 832,396 793,457 1,052,838 million or 36% of FY2024 General Fund City’s population the revenues are projected to

Human Resources 564,807 717,218 717,218 791,491

Planning & Community Development 1,107,608 1,163,221 1,163,221 1,253,330 revenues. grow by $0.9 million, which is $0.2 million over

Information Technology 909,026 1,147,066 1,119,112 1,123,145 last year’s budget.

Animal Services 417,042 444,002 444,002 498,939 Franchise Fees are collected from utility

Fleet Services 1,013,659 1,008,301 1,008,301 1,382,089 companies for right-of-way usage. the Other Revenues include Intergovernmental,

Building Maintenance 571,648 1,283,674 864,674 1,405,907

Police 9,999,045 11,677,772 11,267,723 12,930,816 franchise is paid by various vendors and Interest on investments income, and other

Fire 8,221,404 8,839,311 8,681,187 9,459,080 provide 9% of General Fund Revenues, miscellaneous Revenues. Total in FY2024 is

Emergency Managemment 167,991 524,177 465,553 574,170 estimated to be $3.4 million in fiscal year projected to net $600,000.

Municipal Court 562,392 603,952 603,952 568,657

Street & Drainage 1,175,262 2,073,764 1,892,054 1,698,050 2024.

Parks & Recreation 1,882,539 2,511,299 2,267,921 2,629,996 Interfund tansfers is a $1.6 million budgeted

Library 976,263 1,154,223 1,149,092 1,237,093 transfer from the Oil and Gas fund FY2024.

EDC 421,942 617,166 617,166 2,227,344

Non-Departmental 1,877,740 2,795,134 2,272,955 2,694,888

Transfers 1,458,492 1,458,500 1,458,500 1,517,609

Total Expenditures 32,819,639 39,823,837 37,758,751 44,158,982 Change in General Fund Revenue FY2023 - FY2024

Annual Surplus / (Deficit) 2,228,377 (6,002,133) (1,822,560) (5,963,504)

Fund Balance, Ending 28,911,663 22,909,530 27,089,103 21,125,598 Property Taxes $11,875,000

Fund Balance Breakdown $13,290,015

Reserved (i.e. Encumbrances, Prepaids etc..) (9,541,371) (9,751,371) (10,026,371) (9,399,027) Sales & Other Taxes $13,660,000

Unreserved Fund Balance 19,370,292 13,158,159 17,062,732 11,726,571 $13,660,000

Reserve Policy is 20% of Expenditures 6,563,928 7,964,767 7,551,750 8,831,796 Franchise Fees $3,577,546

Amount over (under) Reserve Policy 12,806,364 5,193,391 9,510,981 2,894,775 $3,380,000

% of Total Expenditures 59% 33% 45% 27% License & Permit $1,063,700

$1,058,700

$357,500

d

n

E

g

n

i

v

r

e

d

e

a

l

a

e

c

n

n

u

F

B

d

l

a

u

F

e

G General Fund ‐ Unreserved Ending Fund Balance Charges for Service $132,500

n

r

e

U

‐

e

r

n

d

n

s

$28,000,000

$24,000,000 $19,370,292 Fines $1,661,550

$1,851,573

$20,000,000 $17,062,732

$16,000,000 $13,158,159 $11,726,571 Interest Income $913,220

$12,000,000 $915,024

$8,000,000 Other Revenues $1,308,675

$4,000,000 $799,690

$0 $1,519,000

Actual 2022 Adopted 2023 Projected 2023 Proposed 2024 Interfund Transfer $3,107,976

$0 $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 $12,000,000 $14,000,000 $16,000,000

FY2023 FY2024