Page 51 - CityofHaltomFY24Budget

P. 51

City Of Haltom City Annual Budget, Fy2024 Budget Overview City Of Haltom City Annual Budget, Fy2024 Budget Overview

SALES TAX FRANCHISE FEES

The City imposes a local option sales tax of 2% on all retail sales, leases, and rentals of most The City imposes a 4% to 8% franchise fee on utility companies for the use of right-of-ways. the

goods, as well as taxable services. The sales tax allocations are: 1.375% for general purposes and types of franchises include gas, electricity, telephone, fiber optics, cable television, solid waste

is recorded in the General Fund, 0.25% is for crime control and prevention and is recorded in the collection, water and sewer, and drainage. Due to legislative changes, some franchise fee have

Crime Control and Prevention District Fund, and the rest of the 0.375% is for street improvements been reduced.

and is recorded in the Street Reconstruction Fund.

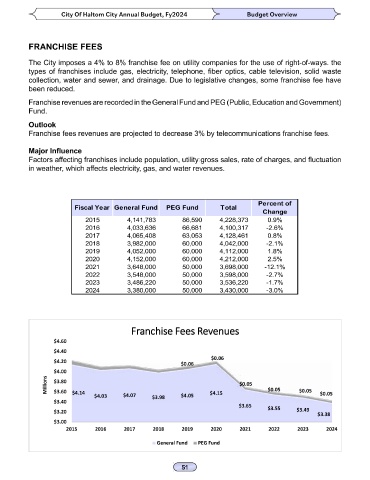

Franchise revenues are recorded in the General Fund and PEG (Public, Education and Government)

Outlook Fund.

The budget for FY2024 projected a growth of approximately 8.8% in sales tax revenues over the Outlook

previous year. Despite maintaining a conservative budgeting approach, our City is experiencing Franchise fees revenues are projected to decrease 3% by telecommunications franchise fees.

increases in sales tax due to a robust local economy and the emergence of new economic

development. In anticipation continued growth, the city has budgeted a continued rise in sales Major Influence

tax revenue as the occupancy of a two large warehouse facilities reaches full capacity and a third Factors affecting franchises include population, utility gross sales, rate of charges, and fluctuation

facility is completed. The also recently announced the new construction for HMart consisting of a in weather, which affects electricity, gas, and water revenues.

new grocery store and 50 restaurants.

Major Influence

Factors affecting sales tax revenues include population, new economic growth, retail sales, strong Percent of

local economy, and consumer price index. Fiscal Year General Fund PEG Fund Total Change

2015 4,141,783 86,590 4,228,373 0.9%

Fiscal General Fund Economic Crime Control Street Total Percent of 2016 4,033,636 66,681 4,100,317 -2.6%

Year Development District Reconstruction Change 2017 4,065,408 63,053 4,128,461 0.8%

2015 6,095,550 3,053,111 1,465,227 1,526,546 12,140,434 7.4% 2018 3,982,000 60,000 4,042,000 -2.1%

2019

1.8%

4,112,000

4,052,000

60,000

2016 6,747,264 3,379,538 1,643,414 1,689,760 13,459,977 10.9% 2020 4,152,000 60,000 4,212,000 2.5%

2017 9,447,444 - 1,662,631 2,577,863 13,687,938 1.7% 2021 3,648,000 50,000 3,698,000 -12.1%

2018 9,636,393 - 1,695,883 2,629,420 13,961,696 2.0% 2022 3,548,000 50,000 3,598,000 -2.7%

2019 10,330,000 - 1,945,787 3,015,803 15,291,590 9.5% 2023 3,486,220 50,000 3,536,220 -1.7%

2020 10,536,600 - 2,043,076 3,000,000 15,579,676 1.9%

2021 10,156,136 - 1,799,206 2,720,206 14,675,548 -5.8% 2024 3,380,000 50,000 3,430,000 -3.0%

2022 11,481,000 - 1,824,374 2,747,258 16,052,632 9.4%

2023 12,794,100 - 2,411,158 2,967,039 18,172,297 13.2%

2024 13,660,000 - 2,619,781 3,500,000 19,779,781 8.8%

Franchise Fees Revenues

Sales Tax Revenues

20 $4.60

18 $3.50 $4.40

16 $2.97 $4.20 $0.06

14 $3.02 $3.00 $2.72 $2.75 $2.41 $2.62 $0.06

12 $1.53 $1.69 $2.58 $2.63 $1.95 $2.04 $1.82 $4.00

10 $1.47 $1.64 $1.66 $1.70 $1.80 Millions $3.80 $0.05

$3.38

MILLIONS 8 6 $3.05 $9.45 $9.64 $10.33 $10.54 $10.16 $11.48 $12.79 $13.66 $3.60 $4.14 $4.03 $4.07 $3.98 $4.05 $4.15 $0.05 $0.05 $0.05

$3.40

2 4 $6.10 $6.75 $3.20 $3.65 $3.55 $3.49 $3.38

0 $3.00

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

General Fund Economic Development Crime Control District Street Reconstruction General Fund PEG Fund