Page 53 - GrapevineFY24 Adopted Budget

P. 53

Key Revenue Drivers and Assumptions

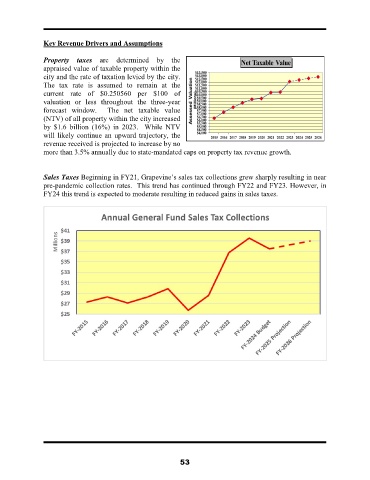

Property taxes are determined by the

appraised value of taxable property within the

city and the rate of taxation levied by the city.

The tax rate is assumed to remain at the

current rate of $0.250560 per $100 of

valuation or less throughout the three-year

forecast window. The net taxable value

(NTV) of all property within the city increased

by $1.6 billion (16%) in 2023. While NTV

will likely continue an upward trajectory, the

revenue received is projected to increase by no

more than 3.5% annually due to state-mandated caps on property tax revenue growth.

Sales Taxes Beginning in FY21, Grapevine’s sales tax collections grew sharply resulting in near

pre-pandemic collection rates. This trend has continued through FY22 and FY23. However, in

FY24 this trend is expected to moderate resulting in reduced gains in sales taxes.

53