Page 57 - City of Fort Worth Budget Book

P. 57

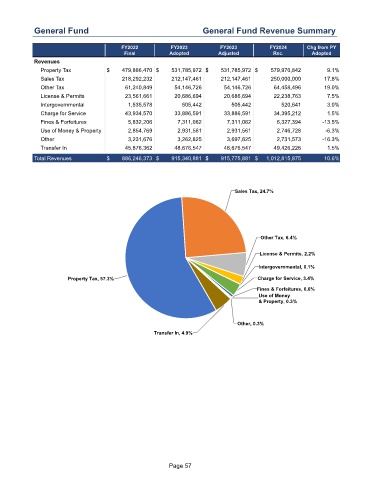

General Fund General Fund Revenue Summary

FY2022 FY2023 FY2023 FY2024 Chg from PY

Final Adopted Adjusted Rec. Adopted

Revenues

Property Tax $ 479,886,470 $ 531,785,972 $ 531,785,972 $ 579,970,842 9.1 %

Sales Tax 218,292,232 212,147,461 212,147,461 250,000,000 17.8 %

Other Tax 61,240,849 54,146,726 54,146,726 64,458,496 19.0 %

License & Permits 23,561,661 20,686,694 20,686,694 22,238,763 7.5 %

Intergovernmental 1,535,578 505,442 505,442 520,641 3.0 %

Charge for Service 43,934,570 33,886,591 33,886,591 34,395,212 1.5 %

Fines & Forfeitures 5,832,206 7,311,062 7,311,062 6,327,394 -13.5 %

Use of Money & Property 2,854,769 2,931,561 2,931,561 2,746,728 -6.3 %

Other 3,231,676 3,262,825 3,697,825 2,731,573 -16.3 %

Transfer In 45,876,362 48,676,547 48,676,547 49,426,226 1.5 %

Total Revenues $ 886,246,373 $ 915,340,881 $ 915,775,881 $ 1,012,815,875 10.6 %

Sales Tax, 24.7%

Other Tax, 6.4%

License & Permits, 2.2%

Intergovernmental, 0.1%

Property Tax, 57.3% Charge for Service, 3.4%

Fines & Forfeitures, 0.6%

Use of Money

& Property, 0.3%

Other, 0.3%

Transfer In, 4.9%

Page 57