Page 161 - City of Fort Worth Budget Book

P. 161

Enterprise Funds Enterprise Fund Statement

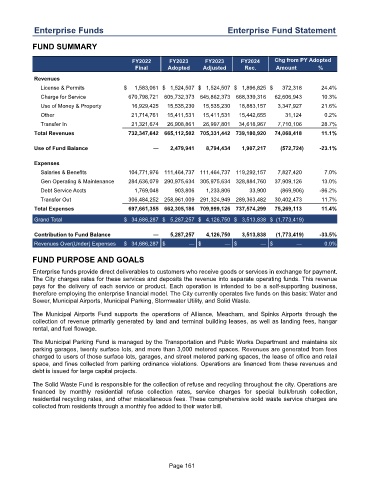

FUND SUMMARY

FY2022 FY2023 FY2023 FY2024 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

License & Permits $ 1,583,061 $ 1,524,507 $ 1,524,507 $ 1,896,825 $ 372,318 24.4 %

Charge for Service 670,798,721 605,732,373 645,862,373 668,339,316 62,606,943 10.3 %

Use of Money & Property 16,929,425 15,535,230 15,535,230 18,883,157 3,347,927 21.6 %

Other 21,714,761 15,411,531 15,411,531 15,442,655 31,124 0.2 %

Transfer In 21,321,674 26,908,861 26,997,801 34,618,967 7,710,106 28.7 %

Total Revenues 732,347,642 665,112,502 705,331,442 739,180,920 74,068,418 11.1 %

Use of Fund Balance — 2,479,941 8,794,434 1,907,217 (572,724) -23.1 %

Expenses

Salaries & Benefits 104,771,976 111,464,737 111,464,737 119,292,157 7,827,420 7.0 %

Gen Operating & Maintenance 284,636,079 290,975,634 305,975,634 328,884,760 37,909,126 13.0 %

Debt Service Accts 1,769,048 903,806 1,233,806 33,900 (869,906) -96.2 %

Transfer Out 306,484,252 258,961,009 291,324,949 289,363,482 30,402,473 11.7 %

Total Expenses 697,661,355 662,305,186 709,999,126 737,574,299 75,269,113 11.4 %

Grand Total $ 34,686,287 $ 5,287,257 $ 4,126,750 $ 3,513,838 $ (1,773,419)

Contribution to Fund Balance — 5,287,257 4,126,750 3,513,838 (1,773,419) -33.5 %

Revenues Over(Under) Expenses $ 34,686,287 $ — $ — $ — $ — 0.0 %

FUND PURPOSE AND GOALS

Enterprise funds provide direct deliverables to customers who receive goods or services in exchange for payment.

The City charges rates for these services and deposits the revenue into separate operating funds. This revenue

pays for the delivery of each service or product. Each operation is intended to be a self-supporting business,

therefore employing the enterprise financial model. The City currently operates five funds on this basis: Water and

Sewer, Municipal Airports, Municipal Parking, Stormwater Utility, and Solid Waste.

The Municipal Airports Fund supports the operations of Alliance, Meacham, and Spinks Airports through the

collection of revenue primarily generated by land and terminal building leases, as well as landing fees, hangar

rental, and fuel flowage.

The Municipal Parking Fund is managed by the Transportation and Public Works Department and maintains six

parking garages, twenty surface lots, and more than 3,000 metered spaces. Revenues are generated from fees

charged to users of those surface lots, garages, and street metered parking spaces, the lease of office and retail

space, and fines collected from parking ordinance violations. Operations are financed from these revenues and

debt is issued for large capital projects.

The Solid Waste Fund is responsible for the collection of refuse and recycling throughout the city. Operations are

financed by monthly residential refuse collection rates, service charges for special bulk/brush collection,

residential recycling rates, and other miscellaneous fees. These comprehensive solid waste service charges are

collected from residents through a monthly fee added to their water bill.

Page 161