Page 146 - City of Fort Worth Budget Book

P. 146

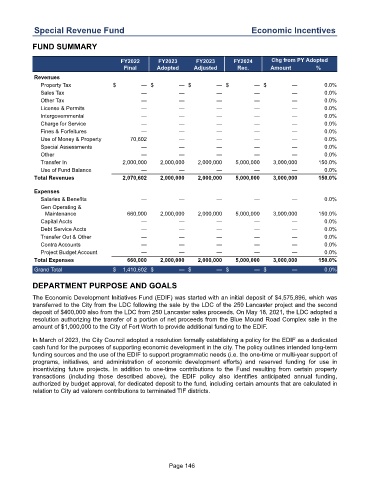

Special Revenue Fund Economic Incentives

FUND SUMMARY

FY2022 FY2023 FY2023 FY2024 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ — $ — $ — $ — $ — 0.0 %

Sales Tax — — — — — 0.0 %

Other Tax — — — — — 0.0 %

License & Permits — — — — — 0.0 %

Intergovernmental — — — — — 0.0 %

Charge for Service — — — — — 0.0 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money & Property 70,602 — — — — 0.0 %

Special Assessments — — — — — 0.0 %

Other — — — — — 0.0 %

Transfer In 2,000,000 2,000,000 2,000,000 5,000,000 3,000,000 150.0 %

Use of Fund Balance — — — — — 0.0 %

Total Revenues 2,070,602 2,000,000 2,000,000 5,000,000 3,000,000 150.0 %

Expenses

Salaries & Benefits — — — — — 0.0 %

Gen Operating &

Maintenance 660,000 2,000,000 2,000,000 5,000,000 3,000,000 150.0 %

Capital Accts — — — — — 0.0 %

Debt Service Accts — — — — — 0.0 %

Transfer Out & Other — — — — — 0.0 %

Contra Accounts — — — — — 0.0 %

Project Budget Account — — — — — 0.0 %

Total Expenses 660,000 2,000,000 2,000,000 5,000,000 3,000,000 150.0 %

Grand Total $ 1,410,602 $ — $ — $ — $ — 0.0 %

DEPARTMENT PURPOSE AND GOALS

The Economic Development Initiatives Fund (EDIF) was started with an initial deposit of $4,575,896, which was

transferred to the City from the LDC following the sale by the LDC of the 250 Lancaster project and the second

deposit of $400,000 also from the LDC from 250 Lancaster sales proceeds. On May 18, 2021, the LDC adopted a

resolution authorizing the transfer of a portion of net proceeds from the Blue Mound Road Complex sale in the

amount of $1,000,000 to the City of Fort Worth to provide additional funding to the EDIF.

In March of 2023, the City Council adopted a resolution formally establishing a policy for the EDIF as a dedicated

cash fund for the purposes of supporting economic development in the city. The policy outlines intended long-term

funding sources and the use of the EDIF to support programmatic needs (i.e. the one-time or multi-year support of

programs, initiatives, and administration of economic development efforts) and reserved funding for use in

incentivizing future projects. In addition to one-time contributions to the Fund resulting from certain property

transactions (including those described above), the EDIF policy also identifies anticipated annual funding,

authorized by budget approval, for dedicated deposit to the fund, including certain amounts that are calculated in

relation to City ad valorem contributions to terminated TIF districts.

Page 146