Page 144 - City of Fort Worth Budget Book

P. 144

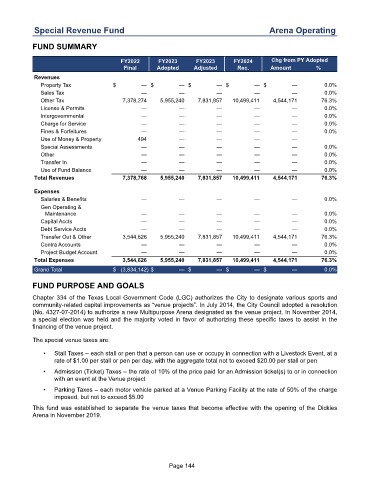

Special Revenue Fund Arena Operating

FUND SUMMARY

FY2022 FY2023 FY2023 FY2024 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ — $ — $ — $ — $ — 0.0 %

Sales Tax — — — — — 0.0 %

Other Tax 7,378,274 5,955,240 7,831,857 10,499,411 4,544,171 76.3 %

License & Permits — — — — — 0.0 %

Intergovernmental — — — — — 0.0 %

Charge for Service — — — — — 0.0 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money & Property 494 — — — —

Special Assessments — — — — — 0.0 %

Other — — — — — 0.0 %

Transfer In — — — — — 0.0 %

Use of Fund Balance — — — — — 0.0 %

Total Revenues 7,378,768 5,955,240 7,831,857 10,499,411 4,544,171 76.3 %

Expenses

Salaries & Benefits — — — — — 0.0 %

Gen Operating &

Maintenance — — — — — 0.0 %

Capital Accts — — — — — 0.0 %

Debt Service Accts — — — — — 0.0 %

Transfer Out & Other 3,544,626 5,955,240 7,831,857 10,499,411 4,544,171 76.3 %

Contra Accounts — — — — — 0.0 %

Project Budget Account — — — — — 0.0 %

Total Expenses 3,544,626 5,955,240 7,831,857 10,499,411 4,544,171 76.3 %

Grand Total $ (3,834,142) $ — $ — $ — $ — 0.0 %

FUND PURPOSE AND GOALS

Chapter 334 of the Texas Local Government Code (LGC) authorizes the City to designate various sports and

community-related capital improvements as “venue projects”. In July 2014, the City Council adopted a resolution

(No. 4327-07-2014) to authorize a new Multipurpose Arena designated as the venue project. In November 2014,

a special election was held and the majority voted in favor of authorizing these specific taxes to assist in the

financing of the venue project.

The special venue taxes are:

• Stall Taxes – each stall or pen that a person can use or occupy in connection with a Livestock Event, at a

rate of $1.00 per stall or pen per day, with the aggregate total not to exceed $20.00 per stall or pen

• Admission (Ticket) Taxes – the rate of 10% of the price paid for an Admission ticket(s) to or in connection

with an event at the Venue project

• Parking Taxes – each motor vehicle parked at a Venue Parking Facility at the rate of 50% of the charge

imposed, but not to exceed $5.00

This fund was established to separate the venue taxes that become effective with the opening of the Dickies

Arena in November 2019.

Page 144