Page 36 - Euless ORD 2360 Adopted FY 23-24 Budget

P. 36

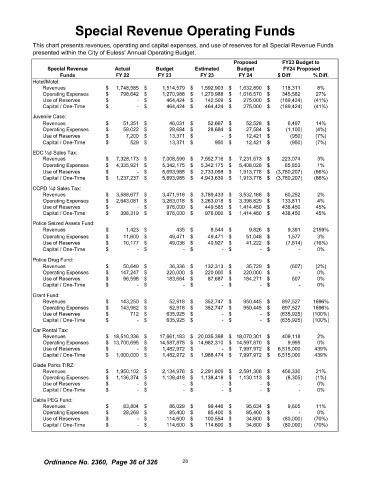

Special Revenue Operating Funds

This chart presents revenues, operating and capital expenses, and use of reserves for all Special Revenue Funds

presented within the City of Euless' Annual Operating Budget.

Proposed FY23 Budget to

Special Revenue Actual Budget Estimated Budget FY24 Proposed

Funds FY 22 FY 23 FY 23 FY 24 Diff Diff.

Hotel/ Motel:

Revenues 1, 748, 585 1, 514, 579 1, 592, 903 1, 632, 890 118, 311 8%

Operating Expenses 798, 642 1, 270, 988 1, 270, 988 1, 616, 570 345, 582 27%

Use of Reserves 464, 424 142, 509 275, 000 189, 424) 41%)

Capital / One -Time 464, 424 464, 424 275, 000 189, 424) 41%)

Juvenile Case:

Revenues 51, 351 46, 031 52, 667 52, 528 6, 497 14%

Operating Expenses 58, 022 28, 684 28, 684 27, 584 1, 100) 4%)

Use of Reserves 7, 200 13, 371 12, 421 950) 7%)

Capital / One -Time 529 13, 371 950 12, 421 950) 7%)

EDC'/ 20 Sales Tax:

Revenues 7, 328, 173 7, 008, 599 7, 552, 716 7, 231, 673 223, 074 3%

Operating Expenses 4, 335, 921 5,342, 175 5, 342, 175 5,408,028 65, 853 1%

Use of Reserves 5,693,985 2, 733, 098 1, 913,778 3, 780, 207) 66%)

Capital / One -Time 1, 237, 237 5, 693, 985 4, 943, 639 1, 913, 778 3, 780, 207) 66%)

CCPD'/ 40 Sales Tax:

Revenues 3, 588, 677 3, 471, 916 3, 789, 433 3, 532, 168 60, 252 2%

Operating Expenses 2, 643, 081 3,263,018 3, 263, 018 3, 396, 829 133, 811 4%

Use of Reserves 976, 000 449, 585 1, 414, 450 438, 450 45%

Capital / One -Time 398, 319 976,000 976, 000 1, 414,450 438, 450 45%

Police Seized Assets Fund:

Revenues 1, 423 435 8, 544 9, 826 9, 391 2159%

Operating Expenses 11, 600 49, 471 49, 471 51, 048 1, 577 3%

Use of Reserves 10, 177 49, 036 40, 927 41, 222 7, 814) 16%)

Capital / One -Time 0%

Police Drug Fund:

Revenues 50, 649 36, 336 132, 313 35, 729 607) 2%)

Operating Expenses 147, 247 220, 000 220, 000 220, 000 0%

Use of Reserves 96, 598 183, 664 87, 687 184, 271 607 0%

Capital / One -Time 0%

Grant Fund:

Revenues 143, 250 52, 918 352, 747 950, 445 897, 527 1696%

Operating Expenses 143, 962 52, 918 352, 747 950, 445 897, 527 1696%

Use of Reserves 712 635, 925 635, 925) 100%)

Capital / One -Time 635, 925 635, 925) 100%)

Car Rental Tax:

Revenues 18, 510, 336 17, 661, 183 20, 035, 398 18, 070, 301 409, 118 2%

Operating Expenses 13, 700, 695 14, 587, 875 14, 982, 310 14, 597, 870 9, 995 0%

Use of Reserves 1, 482, 972 7, 997, 972 6, 515, 000 439%

Capital / One -Time 1, 000, 000 1, 482, 972 1, 988, 474 7, 997, 972 6, 515, 000 439%

Glade Parks TIRZ:

Revenues 1, 950, 102 2, 134, 976 2, 291, 809 2, 591, 306 456, 330 21%

Operating Expenses 1, 136, 374 1, 138, 418 1, 138, 418 1, 130, 113 8, 305) 1%)

Use of Reserves 0%

Capital / One -Time 0%

Cable PEG Fund:

Revenues 83, 804 86, 029 99, 446 95, 634 9, 605 11%

Operating Expenses 28, 269 85, 400 85, 400 85, 400 0%

Use of Reserves 114, 600 100, 554 34, 600 80, 000) 70%)

Capital / One -Time 114, 600 114, 600 34, 600 80, 000) 70%)

Ordinance No. 2360, Page 36 of 326 28