Page 5 - Report

P. 5

Special Revenue Fund (Court Security/Technology Fund) 300

State & Local Fiscal Recovery Fund 400

Debt Service Fund (debt payment for bonds) 600

Enterprise Fund (Water/Sewer) 900

Drainage Fund 910

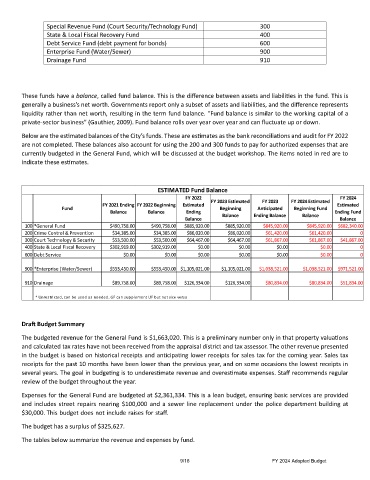

These funds have a balance, called fund balance. This is the difference between assets and liabili�es in the fund. This is

generally a business’s net worth. Governments report only a subset of assets and liabili�es, and the difference represents

liquidity rather than net worth, resul�ng in the term fund balance. “Fund balance is similar to the working capital of a

private-sector business” (Gauthier, 2009). Fund balance rolls over year over year and can fluctuate up or down.

Below are the es�mated balances of the City’s funds. These are es�mates as the bank reconcilia�ons and audit for FY 2022

are not completed. These balances also account for using the 200 and 300 funds to pay for authorized expenses that are

currently budgeted in the General Fund, which will be discussed at the budget workshop. The items noted in red are to

indicate these es�mates.

ESTIMATED Fund Balance

FY 2022 FY 2024

FY 2021 Ending FY 2022 Beginning Estimated FY 2023 Estimated FY 2023 FY 2024 Estimated Estimated

Fund Beginning Anticipated Beginning Fund

Balance Balance Ending Balance Ending Balance Balance Ending Fund

Balance Balance

100 *General Fund $490,758.00 $490,758.00 $885,920.00 $885,920.00 $845,920.00 $845,920.00 $682,340.00

200 Crime Control & Prevention $34,385.00 $34,385.00 $86,020.00 $86,020.00 $61,420.00 $61,420.00 0

300 Court Technology & Security $53,500.00 $53,500.00 $64,467.00 $64,467.00 $61,867.00 $61,867.00 $41,867.00

400 State & Local Fiscal Recovery $302,919.00 $302,919.00 $0.00 $0.00 $0.00 $0.00 0

600 Debt Service $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 0

900 *Enterprise (Water/Sewer) $553,450.00 $553,450.00 $1,105,021.00 $1,105,021.00 $1,038,521.00 $1,038,521.00 $971,521.00

910 Drainage $89,758.00 $89,758.00 $126,334.00 $126,334.00 $80,834.00 $80,834.00 $51,834.00

* Unrestricted, can be used as needed. GF can supplement UF but not vice versa

Dra� Budget Summary

The budgeted revenue for the General Fund is $1,663,020. This is a preliminary number only in that property valua�ons

and calculated tax rates have not been received from the appraisal district and tax assessor . The other revenue presented

in the budget is based on historical receipts and an�cipa�ng lower receipts for sales tax for the coming year . Sales tax

receipts for the past 10 months have been lower than the previous year, and on some occasions the lowest receipts in

several years. The goal in budge�ng is to underes�mate revenue and overes�mate expenses. Staff recommends regular

review of the budget throughout the year .

Expenses for the General Fund are budgeted at $2,361,334. This is a lean budget, ensuring basic services are provided

and includes street repairs nearing $100,000 and a sewer line replacement under the police department building at

$30,000. This budget does not include raises for staff.

The budget has a surplus of $325,627.

The tables below summarize the revenue and expenses by fund.

9/18 FY 2024 Adopted Budget