Page 2 - Report

P. 2

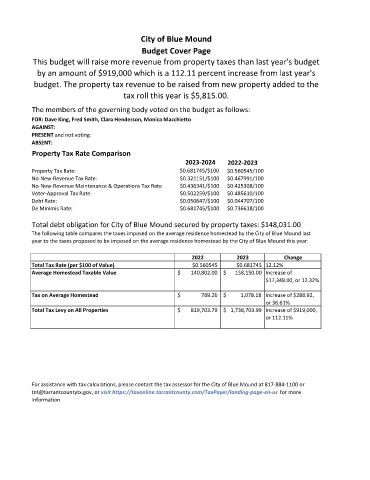

City of Blue Mound

Budget Cover Page

This budget will raise more revenue from property taxes than last year's budget

by an amount of $919,000 which is a 112.11 percent increase from last year's

budget. The property tax revenue to be raised from new property added to the

tax roll this year is $5,815.00.

The members of the governing body voted on the budget as follows:

FOR: Dave King, Fred Smith, Clara Henderson, Monica Macchietto

AGAINST:

PRESENT and not voting:

ABSENT:

Property Tax Rate Comparison

2023-2024 2022-2023

Property Tax Rate: $0.681745/$100 $0.560545/100

No-New-Revenue Tax Rate: $0.321151/$100 $0.467991/100

No-New-Revenue Maintenance & Operations Tax Rate $0.436341/$100 $0.425308/100

Voter-Approval Tax Rate: $0.502259/$100 $0.485610/100

Debt Rate: $0.050647/$100 $0.044707/100

De Minimis Rate: $0.681745/$100 $0.736618/100

Total debt obligation for City of Blue Mound secured by property taxes: $148,031.00

The following table compares the taxes imposed on the average residence homestead by the City of Blue Mound last

year to the taxes proposed to be imposed on the average residence homestead by the City of Blue Mound this year:

2022 2023 Change

Total Tax Rate (per $100 of Value) $0.560545 $0.681745 12.12%

Average Homestead Taxable Value $ 140,802.00 $ 158,150.00 Increase of

$17,348.00, or 12.32%

Tax on Average Homestead $ 789.26 $ 1,078.18 Increase of $288.92,

or 36.61%

Total Tax Levy on All Properties $ 819,703.79 $ 1,738,703.99 Increase of $919,000,

or 112.11%

For assistance with tax calculations, please contact the tax assessor for the City of Blue Mound at 817-884-1100 or

tnt@tarrantcountytx.gov, or visit https://taxonline.tarrantcounty.com/TaxPayer/landing-page-en-us for more

information