Page 381 - FY 2023-24 ADOPTED BUDGET

P. 381

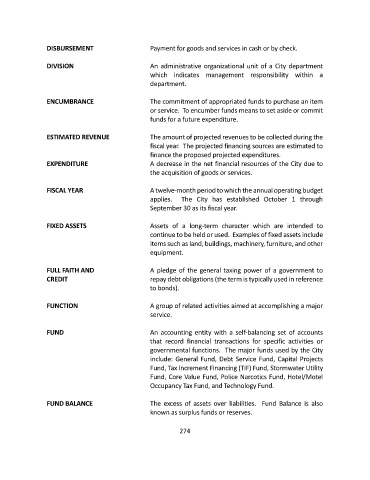

DISBURSEMENT Payment for goods and services in cash or by check.

DIVISION An administrative organizational unit of a City department

which indicates management responsibility within a

department.

ENCUMBRANCE The commitment of appropriated funds to purchase an item

or service. To encumber funds means to set aside or commit

funds for a future expenditure.

ESTIMATED REVENUE The amount of projected revenues to be collected during the

fiscal year. The projected financing sources are estimated to

finance the proposed projected expenditures.

EXPENDITURE A decrease in the net financial resources of the City due to

the acquisition of goods or services.

FISCAL YEAR A twelve-month period to which the annual operating budget

applies. The City has established October 1 through

September 30 as its fiscal year.

FIXED ASSETS Assets of a long-term character which are intended to

continue to be held or used. Examples of fixed assets include

items such as land, buildings, machinery, furniture, and other

equipment.

FULL FAITH AND A pledge of the general taxing power of a government to

CREDIT repay debt obligations (the term is typically used in reference

to bonds).

FUNCTION A group of related activities aimed at accomplishing a major

service.

FUND An accounting entity with a self-balancing set of accounts

that record financial transactions for specific activities or

governmental functions. The major funds used by the City

include: General Fund, Debt Service Fund, Capital Projects

Fund, Tax Increment Financing (TIF) Fund, Stormwater Utility

Fund, Core Value Fund, Police Narcotics Fund, Hotel/Motel

Occupancy Tax Fund, and Technology Fund.

FUND BALANCE The excess of assets over liabilities. Fund Balance is also

known as surplus funds or reserves.

274