Page 323 - FY 2023-24 ADOPTED BUDGET

P. 323

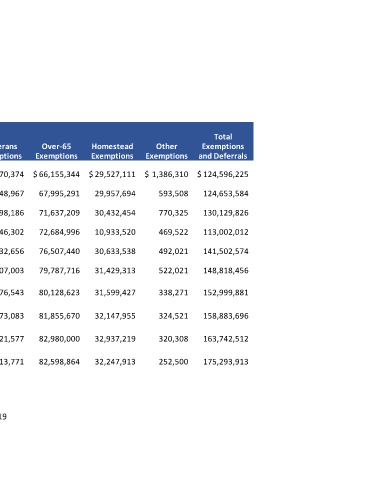

TEN YEAR SUMMARY

PROPERTY TAX RATES AND PROPERTY TAX EXEMPTIONS

(PER $100 OF ASSEDDED VALUATION)

FY 2014-15 TO 2023-24

Debt

General Service Total

Fiscal Fund Fund Total Agricultural Veterans Over-65 Homestead Other Exemptions

Year Tax Rate Tax Rate Tax Rate Deferrals Exemptions Exemptions Exemptions Exemptions and Deferrals

2014-15 0.637500 0.020000 0.657500 $ 12,157,086 $ 15,370,374 $ 66,155,344 $ 29,527,111 $ 1,386,310 $ 124,596,225

2015-16 0.632500 0.025000 0.657500 12,358,124 13,748,967 67,995,291 29,957,694 593,508 124,653,584

2016-17 0.622500 0.027500 0.650000 11,791,652 15,498,186 71,637,209 30,432,454 770,325 130,129,826

2017-18 0.612500 0.027500 0.640000 10,267,672 18,646,302 72,684,996 10,933,520 469,522 113,002,012

2018-19 0.607500 0.032500 0.640000 12,636,919 21,232,656 76,507,440 30,633,538 492,021 141,502,574

2019-20 0.606470 0.021300 0.627770 10,972,403 26,107,003 79,787,716 31,429,313 522,021 148,818,456

2020-21 0.601500 0.021000 0.622500 11,657,017 29,276,543 80,128,623 31,599,427 338,271 152,999,881

2021-22 0.581000 0.036500 0.617500 11,482,467 33,073,083 81,855,670 32,147,955 324,521 158,883,696

2022-23 0.574000 0.021000 0.595000 9,683,408 37,821,577 82,980,000 32,937,219 320,308 163,742,512

2023-24 0.526000 0.039000 0.565000 13,480,865 46,713,771 82,598,864 32,247,913 252,500 175,293,913

219