Page 80 - Bedford-FY23-24 Budget

P. 80

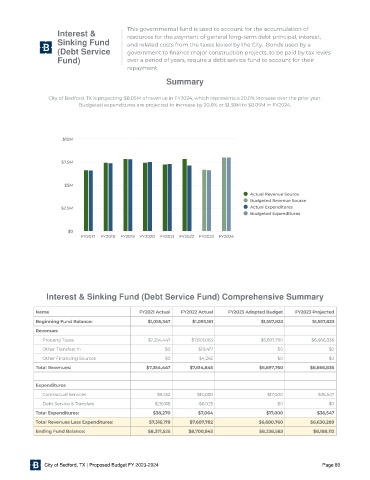

This governmental fund is used to account for the accumulation of

Interest & resources for the payment of general long-term debt principal, interest,

and related costs from the taxes levied by the City. Bonds used by a

Sinking Fund

government to nance major construction projects, to be paid by tax levies

(Debt Service

over a period of years, require a debt service fund to account for their

Fund)

repayment.

Summary

City of Bedford, TX is projecting $8.05M of revenue in FY2024, which represents a 20.0% increase over the prior year.

Budgeted expenditures are projected to increase by 20.8% or $1.38M to $8.05M in FY2024.

$10M

$7.5M

$5M

Ac tual Revenue Source

Budgeted Revenue Source

Ac tual Expenditures

$2 .5M

Budgeted Expenditures

$0

FY2017 FY2018 FY2019 FY2020 FY2021 FY2022 FY2023 FY2024

Interest & Sinking Fund (Debt Service Fund) Comprehensive Summary

Name FY2021 Actual FY2022 Actual FY2023 Adopted Budget FY2023 Projected

Beginning Fund Balance: $1,055,347 $1,093,161 $1,557,823 $1,557,823

Revenues

Property Taxes $7,354,447 $7,600,163 $6,697,760 $6,666,836

Other Transfers In $0 $10,417 $0 $0

Other Financing Sources $0 $4,265 $0 $0

Total Revenues: $7,354,447 $7,614,845 $6,697,760 $6,666,836

Expenditures

Contractual Services $9,252 $15,088 $17,000 $36,547

Debt Service & Transfers $29,018 -$8,025 $0 $0

Total Expenditures: $38,270 $7,064 $17,000 $36,547

Total Revenues Less Expenditures: $7,316,178 $7,607,782 $6,680,760 $6,630,289

Ending Fund Balance: $8,371,525 $8,700,943 $8,238,583 $8,188,112

City of Bedford, TX | Proposed Budget FY 2023-2024 Page 80