Page 73 - CITY OF AZLE, TEXAS

P. 73

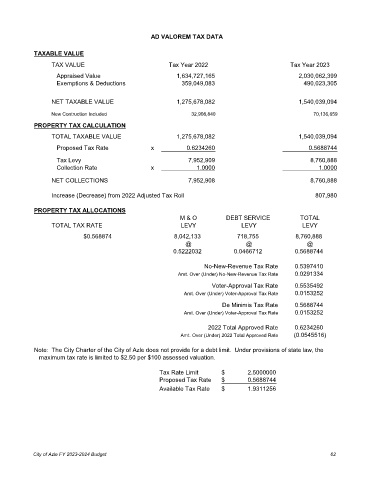

AD VALOREM TAX DATA

TAXABLE VALUE

TAX VALUE Tax Year 2022 Tax Year 2023

Appraised Value 1,634,727,165 2,030,062,399

Exemptions & Deductions 359,049,083 490,023,305

NET TAXABLE VALUE 1,275,678,082 1,540,039,094

New Contruction Included 32,908,840 70,136,659

PROPERTY TAX CALCULATION

TOTAL TAXABLE VALUE 1,275,678,082 1,540,039,094

Proposed Tax Rate x 0.6234260 0.5688744

Tax Levy 7,952,909 8,760,888

Collection Rate x 1.0000 1.0000

NET COLLECTIONS 7,952,908 8,760,888

Increase (Decrease) from 2022 Adjusted Tax Roll 807,980

PROPERTY TAX ALLOCATIONS

M & O DEBT SERVICE TOTAL

TOTAL TAX RATE LEVY LEVY LEVY

$0.568874 8,042,133 718,755 8,760,888

@ @ @

0.5222032 0.0466712 0.5688744

No-New-Revenue Tax Rate 0.5397410

Amt. Over (Under) No-New-Revenue Tax Rate 0.0291334

Voter-Approval Tax Rate 0.5535492

Amt. Over (Under) Voter-Approval Tax Rate 0.0153252

De Minimis Tax Rate 0.5688744

Amt. Over (Under) Voter-Approval Tax Rate 0.0153252

2022 Total Approved Rate 0.6234260

Amt. Over (Under) 2022 Total Approved Rate (0.0545516)

Note: The City Charter of the City of Azle does not provide for a debt limit. Under provisions of state law, the

maximum tax rate is limited to $2.50 per $100 assessed valuation.

Tax Rate Limit $ 2.5000000

Proposed Tax Rate $ 0.5688744

Available Tax Rate $ 1.9311256

City of Azle FY 2023-2024 Budget 62