Page 25 - CITY OF AZLE, TEXAS

P. 25

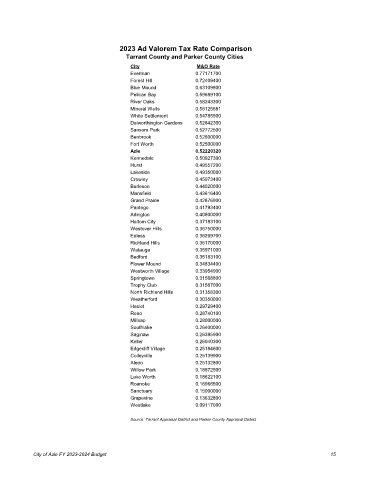

2023 Ad Valorem Tax Rate Comparison

Tarrant County and Parker County Cities

City M&O Rate

Everman 0.77171700

Forest Hill 0.72409400

Blue Mound 0.63109800

Pelican Bay 0.59689100

River Oaks 0.58243300

Mineral Wells 0.56125681

White Settlement 0.54785500

Dalworthington Gardens 0.52842300

Sansom Park 0.52772500

Benbrook 0.52600000

Fort Worth 0.52500000

Azle 0.52220320

Kennedale 0.50927300

Hurst 0.49557200

Lakeside 0.49350000

Crowley 0.45973400

Burleson 0.44020000

Mansfield 0.43616400

Grand Prairie 0.42876900

Pantego 0.41793400

Arlington 0.40800000

Haltom City 0.37183100

Westover Hills 0.36750000

Euless 0.36269700

Richland Hills 0.36170000

Watauga 0.35971000

Bedford 0.35183100

Flower Mound 0.34834400

Westworth Village 0.33954900

Springtown 0.31568800

Trophy Club 0.31567000

North Richland Hills 0.31358300

Weatherford 0.30350000

Haslet 0.29729400

Reno 0.28740100

Millsap 0.28000000

Southlake 0.26400000

Saginaw 0.26395900

Keller 0.26040300

Edgecliff Village 0.25184600

Colleyville 0.25139900

Aledo 0.25132800

Willow Park 0.18872500

Lake Worth 0.18622100

Roanoke 0.16966500

Sanctuary 0.15000000

Grapevine 0.13632800

Westlake 0.09117000

Source: Tarrant Appraisal District and Parker County Appraisal District

City of Azle FY 2023-2024 Budget 15