Page 14 - CITY OF AZLE, TEXAS

P. 14

various revenue sources in order to come up with reasonable revenue estimates. Property

appraisals from Tarrant Appraisal District and Parker County Appraisal District were used to

estimate this year’s property tax revenues and comprise the only estimates from other

governments used to determine revenues. Revenues in the Utility Fund were estimated after

determining actual increases in the amount of accounts due to recent growth along with

projections for the coming year.

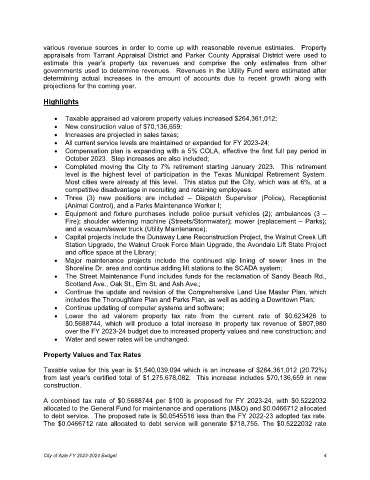

Highlights

• Taxable appraised ad valorem property values increased $264,361,012;

• New construction value of $70,136,659;

• Increases are projected in sales taxes;

• All current service levels are maintained or expanded for FY 2023-24;

• Compensation plan is expanding with a 5% COLA, effective the first full pay period in

October 2023. Step increases are also included;

• Completed moving the City to 7% retirement starting January 2023. This retirement

level is the highest level of participation in the Texas Municipal Retirement System.

Most cities were already at this level. This status put the City, which was at 6%, at a

competitive disadvantage in recruiting and retaining employees.

• Three (3) new positions are included – Dispatch Supervisor (Police), Receptionist

(Animal Control), and a Parks Maintenance Worker I;

• Equipment and fixture purchases include police pursuit vehicles (2); ambulances (3 –

Fire); shoulder widening machine (Streets/Stormwater); mower (replacement – Parks);

and a vacuum/sewer truck (Utility Maintenance);

• Capital projects include the Dunaway Lane Reconstruction Project, the Walnut Creek Lift

Station Upgrade, the Walnut Creek Force Main Upgrade, the Avondale Lift State Project

and office space at the Library;

• Major maintenance projects include the continued slip lining of sewer lines in the

Shoreline Dr. area and continue adding lift stations to the SCADA system;

• The Street Maintenance Fund includes funds for the reclamation of Sandy Beach Rd.,

Scotland Ave., Oak St., Elm St. and Ash Ave.;

• Continue the update and revision of the Comprehensive Land Use Master Plan, which

includes the Thoroughfare Plan and Parks Plan, as well as adding a Downtown Plan;

• Continue updating of computer systems and software;

• Lower the ad valorem property tax rate from the current rate of $0.623426 to

$0.5688744, which will produce a total increase in property tax revenue of $807,980

over the FY 2023-24 budget due to increased property values and new construction; and

• Water and sewer rates will be unchanged.

Property Values and Tax Rates

Taxable value for this year is $1,540,039,094 which is an increase of $264,361,012 (20.72%)

from last year’s certified total of $1,275,678,082. This increase includes $70,136,659 in new

construction.

A combined tax rate of $0.5688744 per $100 is proposed for FY 2023-24, with $0.5222032

allocated to the General Fund for maintenance and operations (M&O) and $0.0466712 allocated

to debt service. The proposed rate is $0.0545516 less than the FY 2022-23 adopted tax rate.

The $0.0466712 rate allocated to debt service will generate $718,755. The $0.5222032 rate

City of Azle FY 2023-2024 Budget 4