Page 52 - Watauga FY22-23 Budget

P. 52

BUDGET OVERVIEW – BUDGET-IN-BRIEF

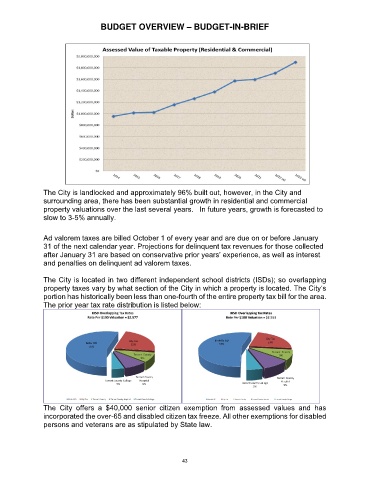

The City is landlocked and approximately 96% built out, however, in the City and

surrounding area, there has been substantial growth in residential and commercial

property valuations over the last several years. In future years, growth is forecasted to

slow to 3-5% annually.

Ad valorem taxes are billed October 1 of every year and are due on or before January

31 of the next calendar year. Projections for delinquent tax revenues for those collected

after January 31 are based on conservative prior years’ experience, as well as interest

and penalties on delinquent ad valorem taxes.

The City is located in two different independent school districts (ISDs); so overlapping

property taxes vary by what section of the City in which a property is located. The City‘s

portion has historically been less than one-fourth of the entire property tax bill for the area.

The prior year tax rate distribution is listed below:

The City offers a $40,000 senior citizen exemption from assessed values and has

incorporated the over-65 and disabled citizen tax freeze. All other exemptions for disabled

persons and veterans are as stipulated by State law.

43