Page 51 - Watauga FY22-23 Budget

P. 51

BUDGET OVERVIEW – BUDGET-IN-BRIEF

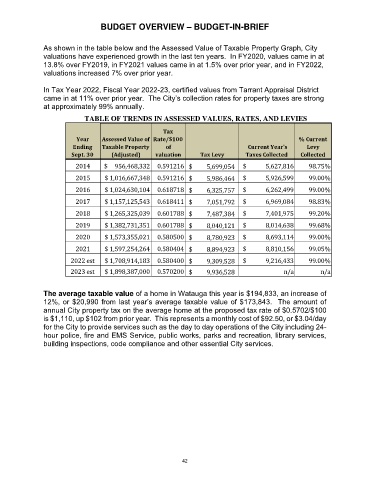

As shown in the table below and the Assessed Value of Taxable Property Graph, City

valuations have experienced growth in the last ten years. In FY2020, values came in at

13.8% over FY2019, in FY2021 values came in at 1.5% over prior year, and in FY2022,

valuations increased 7% over prior year.

In Tax Year 2022, Fiscal Year 2022-23, certified values from Tarrant Appraisal District

came in at 11% over prior year. The City’s collection rates for property taxes are strong

at approximately 99% annually.

TABLE OF TRENDS IN ASSESSED VALUES, RATES, AND LEVIES

Tax

Year Assessed Value of Rate/$100 % Current

Ending Taxable Property of Current Year's Levy

Sept. 30 (Adjusted) valuation Tax Levy Taxes Collected Collected

2014 $ 956,468,332 0.591216 $ 5,699,054 $ 5,627,816 98.75%

2015 $ 1,016,667,348 0.591216 $ 5,986,464 $ 5,926,599 99.00%

2016 $ 1,024,630,104 0.618718 $ 6,325,757 $ 6,262,499 99.00%

2017 $ 1,157,125,543 0.618411 $ 7,051,792 $ 6,969,084 98.83%

2018 $ 1,265,325,039 0.601788 $ 7,487,384 $ 7,401,975 99.20%

2019 $ 1,382,731,351 0.601788 $ 8,040,121 $ 8,014,638 99.68%

2020 $ 1,573,355,021 0.580500 $ 8,780,923 $ 8,693,114 99.00%

2021 $ 1,597,254,264 0.580404 $ 8,894,923 $ 8,810,156 99.05%

2022 est $ 1,708,914,183 0.580400 $ 9,309,528 $ 9,216,433 99.00%

2023 est $ 1,898,387,000 0.570200 $ 9,936,528 n/a n/a

The average taxable value of a home in Watauga this year is $194,833, an increase of

12%, or $20,990 from last year’s average taxable value of $173,843. The amount of

annual City property tax on the average home at the proposed tax rate of $0.5702/$100

is $1,110, up $102 from prior year. This represents a monthly cost of $92.50, or $3.04/day

for the City to provide services such as the day to day operations of the City including 24-

hour police, fire and EMS Service, public works, parks and recreation, library services,

building inspections, code compliance and other essential City services.

42