Page 300 - Watauga FY22-23 Budget

P. 300

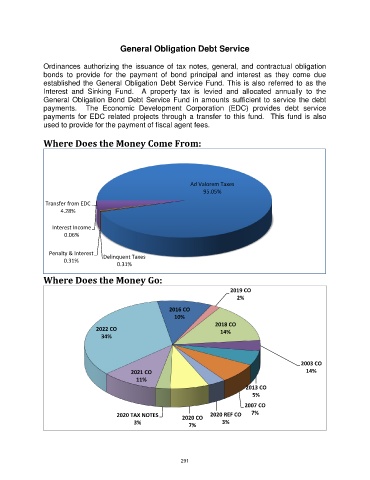

General Obligation Debt Service

Ordinances authorizing the issuance of tax notes, general, and contractual obligation

bonds to provide for the payment of bond principal and interest as they come due

established the General Obligation Debt Service Fund. This is also referred to as the

Interest and Sinking Fund. A property tax is levied and allocated annually to the

General Obligation Bond Debt Service Fund in amounts sufficient to service the debt

payments. The Economic Development Corporation (EDC) provides debt service

payments for EDC related projects through a transfer to this fund. This fund is also

used to provide for the payment of fiscal agent fees.

Where Does the Money Come From:

Ad Valorem Taxes

95.05%

Transfer from EDC

4.28%

Interest Income

0.06%

Penalty & Interest Delinquent Taxes

0.31%

0.31%

Where Does the Money Go:

2019 CO

2%

2016 CO

10%

2018 CO

2022 CO 14%

34%

2003 CO

2021 CO 14%

11%

2013 CO

5%

2007 CO

2020 TAX NOTES 2020 REF CO 7%

2020 CO

3% 3%

7%

291