Page 298 - Watauga FY22-23 Budget

P. 298

DEBT SERVICE

rating cited very strong budgetary flexibility, very strong liquidity, adequate budgetary

performance and adequate debt and contingent liabilities.

Standard & Poor’s also assigned its ‘AA’ long term rating to the City’s $5.885 million

Combination and Limited Pledge Revenue Certificates of Obligation, 2016. The rating

cited very strong management, with strong financial policies and practices, very strong

budgetary flexibility, very strong liquidity and adequate economy and budgetary

performance in support of this rating. Standard and Poor’s also assigned its ‘AA’ long-

term rating to the 2017 Certificates of Obligation issuance and 2018 Certificates of

Obligation Issuance.

In recent years, S&P Global Ratings assigned its ‘AA’ long-term rating to the 2019,

2020, 2021, and 2022 issuances and affirmed their ‘AA’ rating on the city’s certificates

outstanding. The rating is based on the City’s very strong reserves combined with

steady budgetary performance produced by a very strong financial management team.

In addition, S&P cited expectations for the city to continue stable operations and the

projection for assessed values in the city to continue growth.

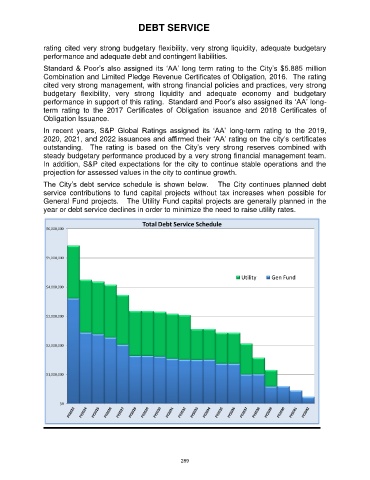

The City’s debt service schedule is shown below. The City continues planned debt

service contributions to fund capital projects without tax increases when possible for

General Fund projects. The Utility Fund capital projects are generally planned in the

year or debt service declines in order to minimize the need to raise utility rates.

289