Page 246 - Watauga FY22-23 Budget

P. 246

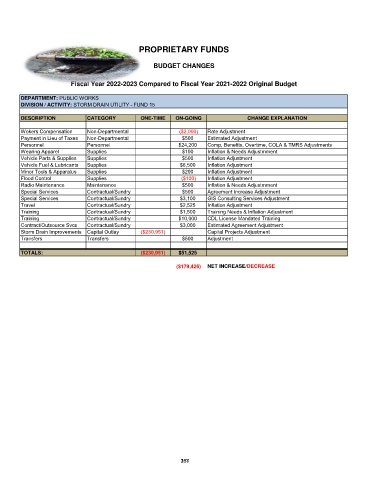

PROPRIETARY FUNDS

BUDGET CHANGES

Fiscal Year 2022-2023 Compared to Fiscal Year 2021-2022 Original Budget

DEPARTMENT: PUBLIC WORKS

DIVISION / ACTIVITY: STORM DRAIN UTILITY - FUND 15

DESCRIPTION CATEGORY ONE-TIME ON-GOING CHANGE EXPLANATION

Wokers Compensation Non-Departmental ($2,000) Rate Adjustment

Payment in Lieu of Taxes Non-Departmental $500 Estimated Adjustment

Personnel Personnel $24,200 Comp, Benefits, Overtime, COLA & TMRS Adjustments

Wearing Apparel Supplies $100 Inflation & Needs Adjustmment

Vehicle Parts & Supplies Supplies $500 Inflation Adjustment

Vehicle Fuel & Lubricants Supplies $6,500 Inflation Adjustment

Minor Tools & Apparatus Supplies $200 Inflation Adjustment

Flood Control Supplies ($100) Inflation Adjustment

Radio Maintenance Maintenance $500 Inflation & Needs Adjustmment

Special Services Contractual/Sundry $500 Agreement Increase Adjustment

Special Services Contractual/Sundry $3,100 GIS Consulting Services Adjustment

Travel Contractual/Sundry $2,525 Inflation Adjustment

Training Contractual/Sundry $1,500 Training Needs & Inflation Adjustment

Training Contractual/Sundry $10,000 CDL License Mandated Training

Contract/Outsource Svcs Contractual/Sundry $3,000 Estimated Agreement Adjustment

Storm Drain Improvements Capital Outlay ($230,951) Capital Projects Adjustment

Transfers Transfers $500 Adjustment

TOTALS: ($230,951) $51,525

($179,426) NET INCREASE/DECREASE

237

163