Page 127 - Southlake FY23 Budget

P. 127

CITY PROFILE

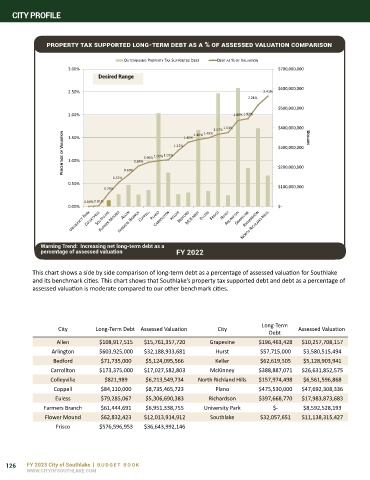

ProPerty tax SuPPorteD long-term Debt aS a % of aSSeSSeD Valuation ComPariSon

OUTSTANDING PROPERTY TAX SUPPORTED DEBT DEBT AS % OF VALUATION

3.00% $700,000,000

Desired Range

$600,000,000

2.50% 2.41%

2.21%

$500,000,000

2.00% 1.88% 1.92%

1.57% 1.61% $400,000,000 DOLLARS

PERCENTAGE OF VALUATION 1.00% 0.88% 0.96% 1.00% 1.02% 1.22% $300,000,000

1.49%

1.46%

1.50%

1.40%

0.52% 0.69% $200,000,000

0.50%

0.29% $100,000,000

0.00% 0.01%

0.00% $-

Warning Trend: Increasing net long-term debt as a

percentage of assessed valuation FY 2022

This chart shows a side by side comparison of long-term debt as a percentage of assessed valuation for Southlake

and its benchmark cities. This chart shows that Southlake’s property tax supported debt and debt as a percentage of

assessed valuation is moderate compared to our other benchmark cities.

Long-Term

City Long-Term Debt Assessed Valuation City Assessed Valuation

Debt

Allen $108,917,515 $15,761,357,720 Grapevine $196,463,428 $10,257,708,157

Arlington $603,925,000 $32,188,933,681 Hurst $57,715,000 $3,580,515,494

Bedford $71,735,000 $5,124,095,566 Keller $62,619,505 $5,128,903,941

Carrollton $173,375,000 $17,027,582,803 McKinney $388,887,071 $26,631,852,575

Colleyville $821,989 $6,213,549,734 North Richland Hills $157,974,498 $6,561,596,868

Coppell $84,110,000 $8,735,465,723 Plano $475,530,000 $47,692,308,336

Euless $79,285,067 $5,306,690,383 Richardson $397,668,770 $17,983,873,683

Farmers Branch $61,444,691 $6,951,338,755 University Park $- $8,592,528,193

Flower Mound $62,832,423 $12,013,914,912 Southlake $32,057,651 $11,138,315,427

Frisco $576,596,953 $36,643,992,146

126 FY 2023 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM