Page 23 - GFOA Draft 2

P. 23

Other major issues in each of the operating funds of the City are outlined as follows:

GENERAL FUND

This year our estimated General Fund Revenues total $20,587,725. Expenditures total

$21,373,350. The difference of $785,625 will be funded using existing fund balance. The

draw-down of fund balance will be used for non-recurring and one-time capital purchases.

Examples of one-time expenditures include fencing for Fire Station 2, roof repair for the

Police Department, updated code books and a new vehicle for the Inspections

department, and a generator for the Recreation Center. Our ending balance on

September 30, 2022 is estimated at $11,094,880.

The two major sources of revenue consist of $6,700,000 from sales tax revenue and

$7,166,080 from ad valorem tax revenue. The 2022 taxable value is $2,624,817,142 and

reflects $44,497,540 in new construction. The taxable value increased by 9.46% this

fiscal year. The approved budget is based on a 2022 tax rate of $0.508042, which is

2.8526 cents more than the 2021 rate of $0.479516, with $0.273156 for maintenance and

operations, and $0.234886 for debt service.

Sales tax revenues fluctuate from month to month but have remained strong for the last

several years. We estimate that we will receive $6,700,000 in sales tax revenue, which

is higher than the amount we collected in FY2021-2022.

General Fund expenditures have increased by $1,254,655 when compared to the

previous year’s revised budget. The increase is due to new departments added to the

current fiscal year and increases in the Fire and Police budgets for salaries, insurance,

and new and upgraded equipment.

A separate document (Budget Guidelines) is prepared for Department Heads and

identifies the expenditures by account number with explanations for each. The FY 2021-

2022 General Fund Revised Budget is $20,118,695. The approved 2022-2023 budget is

$21,373,350.

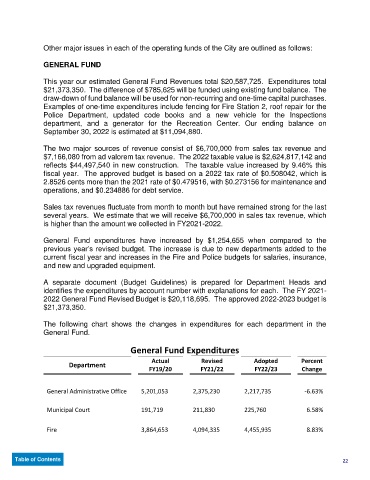

The following chart shows the changes in expenditures for each department in the

General Fund.

General Fund Expenditures

Actual Revised Adopted Percent

Department

FY19/20 FY21/22 FY22/23 Change

General Administrative Office 5,201,053 2,375,230 2,217,735 -6.63%

Municipal Court 191,719 211,830 225,760 6.58%

Fire 3,864,653 4,094,335 4,455,935 8.83%

Table of Contents 22