Page 385 - Cover 3.psd

P. 385

ADOPTED | BUDGET

Certificates of Obligation (CO’s) – Certificates of Obligation are used to fund capital

requirements that are not otherwise covered under either Revenue Bonds or General

Obligation Bonds. Debt Service for CO’s may be either from general revenues or backed by a

specific revenue stream or streams, or by a combination thereof. Generally, CO’s are issued

for the acquisition or construction of capital assets.

Analysis of Financial Alternatives – Staff will explore alternatives to the issuance of debt for capital

acquisitions and construction projects. These alternatives include, but are not limited to: (1) grants-

in-aid, (2) use of reserves, (3) use of current revenues, (4) contributions from developers and others,

(5) leases, and (6) impact fees.

Disclosure – Full disclosure of operations will be made to the bond rating agencies and other users

of financial information. City staff, with the assistance of financial advisors and bond counsel, will

prepare necessary materials for presentation to the rating agencies, aid in the production of Official

Statements, and take responsibility for the accuracy of all financial information released.

Federal Requirements – The City will maintain procedures to comply with arbitrage rebate and other

Federal requirements.

Debt Limit – The State of Texas limits the ad valorem tax rate to $2.50 per $100 valuation. The City

Charter limits the ad valorem tax rate to $1.50 per $100 valuation of taxable property within the City.

North Richland Hills’ adopted rate of $0.547972 falls well below this limit.

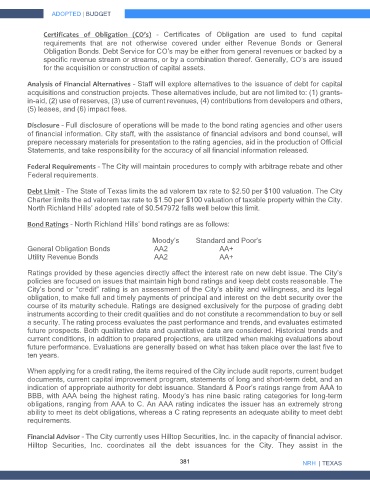

Bond Ratings – North Richland Hills’ bond ratings are as follows:

Moody’s Standard and Poor’s

General Obligation Bonds AA2 AA+

Utility Revenue Bonds AA2 AA+

Ratings provided by these agencies directly affect the interest rate on new debt issue. The City’s

policies are focused on issues that maintain high bond ratings and keep debt costs reasonable. The

City’s bond or “credit” rating is an assessment of the City’s ability and willingness, and its legal

obligation, to make full and timely payments of principal and interest on the debt security over the

course of its maturity schedule. Ratings are designed exclusively for the purpose of grading debt

instruments according to their credit qualities and do not constitute a recommendation to buy or sell

a security. The rating process evaluates the past performance and trends, and evaluates estimated

future prospects. Both qualitative data and quantitative data are considered. Historical trends and

current conditions, in addition to prepared projections, are utilized when making evaluations about

future performance. Evaluations are generally based on what has taken place over the last five to

ten years.

When applying for a credit rating, the items required of the City include audit reports, current budget

documents, current capital improvement program, statements of long and short-term debt, and an

indication of appropriate authority for debt issuance. Standard & Poor’s ratings range from AAA to

BBB, with AAA being the highest rating. Moody’s has nine basic rating categories for long-term

obligations, ranging from AAA to C. An AAA rating indicates the issuer has an extremely strong

ability to meet its debt obligations, whereas a C rating represents an adequate ability to meet debt

requirements.

Financial Advisor – The City currently uses Hilltop Securities, Inc. in the capacity of financial advisor.

Hilltop Securities, Inc. coordinates all the debt issuances for the City. They assist in the

381 NRH | TEXAS