Page 141 - Cover 3.psd

P. 141

ADOPTED | BUDGET

Overview of the Crime Control and

Prevention District

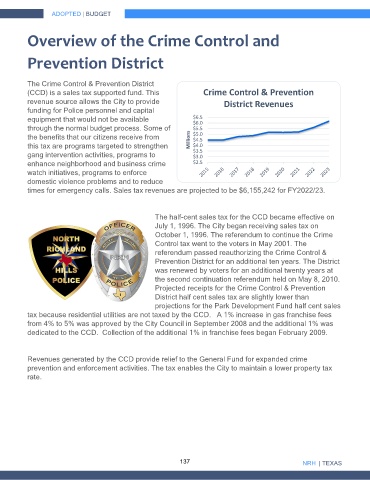

The Crime Control & Prevention District

(CCD) is a sales tax supported fund. This Crime Control & Prevention

revenue source allows the City to provide District Revenues

funding for Police personnel and capital

equipment that would not be available $6.5

$6.0

through the normal budget process. Some of $5.5

the benefits that our citizens receive from Millions $5.0

$4.5

this tax are programs targeted to strengthen $4.0

gang intervention activities, programs to $3.5

$3.0

enhance neighborhood and business crime $2.5

watch initiatives, programs to enforce

domestic violence problems and to reduce

times for emergency calls. Sales tax revenues are projected to be $6,155,242 for FY2022/23.

The half-cent sales tax for the CCD became effective on

July 1, 1996. The City began receiving sales tax on

October 1, 1996. The referendum to continue the Crime

Control tax went to the voters in May 2001. The

referendum passed reauthorizing the Crime Control &

Prevention District for an additional ten years. The District

was renewed by voters for an additional twenty years at

the second continuation referendum held on May 8, 2010.

Projected receipts for the Crime Control & Prevention

District half cent sales tax are slightly lower than

projections for the Park Development Fund half cent sales

tax because residential utilities are not taxed by the CCD. A 1% increase in gas franchise fees

from 4% to 5% was approved by the City Council in September 2008 and the additional 1% was

dedicated to the CCD. Collection of the additional 1% in franchise fees began February 2009.

Revenues generated by the CCD provide relief to the General Fund for expanded crime

prevention and enforcement activities. The tax enables the City to maintain a lower property tax

rate.

137 NRH | TEXAS