Page 128 - CityofMansfieldFY23Budget

P. 128

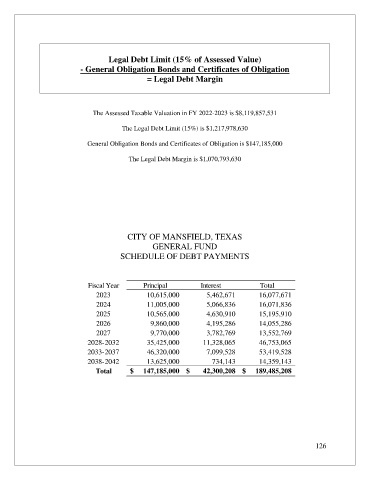

Legal Debt Limit (15% of Assessed Value)

- General Obligation Bonds and Certificates of Obligation

= Legal Debt Margin

The Assessed Taxable Valuation in FY 2022-2023 is $8,119,857,531

The Legal Debt Limit (15%) is $1,217,978,630

General Obligation Bonds and Certificates of Obligation is $147,185,000

The Legal Debt Margin is $1,070,793,630

CITY OF MANSFIELD, TEXAS

GENERAL FUND

SCHEDULE OF DEBT PAYMENTS

Fiscal Year Principal Interest Total

2023 10,615,000 5,462,671 16,077,671

2024 11,005,000 5,066,836 16,071,836

2025 10,565,000 4,630,910 15,195,910

2026 9,860,000 4,195,286 14,055,286

2027 9,770,000 3,782,769 13,552,769

2028-2032 35,425,000 11,328,065 46,753,065

2033-2037 46,320,000 7,099,528 53,419,528

2038-2042 13,625,000 734,143 14,359,143

Total $ 147,185,000 $ 42,300,208 $ 189,485,208

126