Page 260 - HurstFY23AnnualBudget

P. 260

APPROVED BUDGET FISCAL YEAR 2022-2023

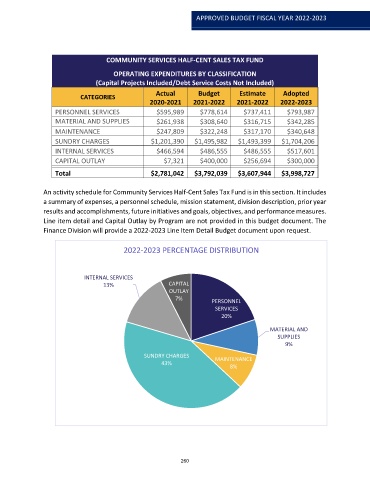

COMMUNITY SERVICES HALF-CENT SALES TAX FUND

OPERATING EXPENDITURES BY CLASSIFICATION

(Capital Projects Included/Debt Service Costs Not Included)

Actual Budget Estimate Adopted

CATEGORIES

2020-2021 2021-2022 2021-2022 2022-2023

PERSONNEL SERVICES $595,989 $778,614 $737,411 $793,987

MATERIAL AND SUPPLIES $261,938 $308,640 $316,715 $342,285

MAINTENANCE $247,809 $322,248 $317,170 $340,648

SUNDRY CHARGES $1,201,390 $1,495,982 $1,493,399 $1,704,206

INTERNAL SERVICES $466,594 $486,555 $486,555 $517,601

CAPITAL OUTLAY $7,321 $400,000 $256,694 $300,000

Total $2,781,042 $3,792,039 $3,607,944 $3,998,727

An activity schedule for Community Services Half-Cent Sales Tax Fund is in this section. It includes

a summary of expenses, a personnel schedule, mission statement, division description, prior year

results and accomplishments, future initiatives and goals, objectives, and performance measures.

Line item detail and Capital Outlay by Program are not provided in this budget document. The

Finance Division will provide a 2022-2023 Line Item Detail Budget document upon request.

2022-2023 PERCENTAGE DISTRIBUTION

INTERNAL SERVICES

13% CAPITAL

OUTLAY

7%

PERSONNEL

SERVICES

20%

MATERIAL AND

SUPPLIES

9%

SUNDRY CHARGES MAINTENANCE

43%

8%

260