Page 107 - HurstFY23AnnualBudget

P. 107

APPROVED BUDGET FISCAL YEAR 2022-2023

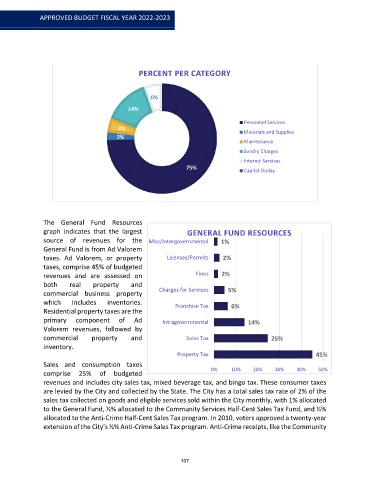

PERCENT PER CATEGORY

0%

5%

14%

Personnel Services

4%

Materials and Supplies

2%

Maintenance

Sundry Charges

Internal Services

75%

Capital Outlay

The General Fund Resources

graph indicates that the largest GENERAL FUND RESOURCES

source of revenues for the Misc/Intergovernmental 1%

General Fund is from Ad Valorem

taxes. Ad Valorem, or property Licenses/Permits 2%

taxes, comprise 45% of budgeted

revenues and are assessed on Fines 2%

both real property and

Charges for Services 5%

commercial business property

which includes inventories. Franchise Tax 6%

Residential property taxes are the

primary component of Ad Intragovernmental 14%

Valorem revenues, followed by

commercial property and Sales Tax 25%

inventory.

Property Tax 45%

Sales and consumption taxes

0% 10% 20% 30% 40% 50%

comprise 25% of budgeted

revenues and includes city sales tax, mixed beverage tax, and bingo tax. These consumer taxes

are levied by the City and collected by the State. The City has a total sales tax rate of 2% of the

sales tax collected on goods and eligible services sold within the City monthly, with 1% allocated

to the General Fund, ½% allocated to the Community Services Half-Cent Sales Tax Fund, and ½%

allocated to the Anti-Crime Half-Cent Sales Tax program. In 2010, voters approved a twenty-year

extension of the City’s ½% Anti-Crime Sales Tax program. Anti-Crime receipts, like the Community

107