Page 93 - FortWorthFY23AdoptedBudget

P. 93

General Fund

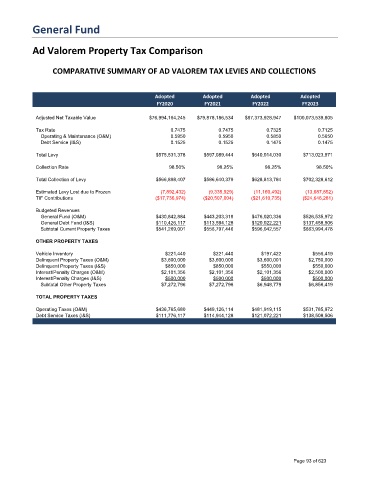

Ad Valorem Property Tax Comparison

COMPARATIVE SUMMARY OF AD VALOREM TAX LEVIES AND COLLECTIONS

Adopted Adopted Adopted Adopted

FY2020 FY2021 FY2022 FY2023

Adjusted Net Taxable Value $76,994,164,245 $79,878,186,534 $87,373,928,947 $100,073,539,805

Tax Rate 0.7475 0.7475 0.7325 0.7125

Operating & Maintenance (O&M) 0.5950 0.5950 0.5850 0.5650

Debt Service (I&S) 0.1525 0.1525 0.1475 0.1475

Total Levy $575,531,378 $597,089,444 $640,014,030 $713,023,971

Collection Rate 98.50% 98.25% 98.25% 98.50%

Total Collection of Levy $566,898,407 $586,640,379 $628,813,784 $702,328,612

Estimated Levy Lost due to Frozen (7,892,432) (9,335,929) (11,160,492) (13,687,852)

TIF Contributions ($17,736,974) ($20,507,004) ($21,610,735) ($24,646,281)

Budgeted Revenues

General Fund (O&M) $430,842,884 $443,203,318 $476,020,336 $526,535,972

General Debt Fund (I&S) $110,426,117 $113,594,128 $120,022,221 $137,458,506

Subtotal Current Property Taxes $541,269,001 $556,797,446 $596,042,557 $663,994,478

OTHER PROPERTY TAXES

Vehicle Inventory $221,440 $221,440 $197,422 $556,419

Delinquent Property Taxes (O&M) $3,600,000 $3,600,000 $3,600,001 $2,750,000

Delinquent Property Taxes (I&S) $850,000 $850,000 $550,000 $550,000

Interest/Penalty Charges (O&M) $2,101,356 $2,101,356 $2,101,356 $2,500,000

Interest/Penalty Charges (I&S) $500,000 $500,000 $500,000 $500,000

Subtotal Other Property Taxes $7,272,796 $7,272,796 $6,948,779 $6,856,419

TOTAL PROPERTY TAXES

Operating Taxes (O&M) $436,765,680 $449,126,114 $481,919,115 $531,785,972

Debt Service Taxes (I&S) $111,776,117 $114,944,128 $121,072,221 $138,508,506

Page 93 of 623