Page 92 - FortWorthFY23AdoptedBudget

P. 92

General Fund

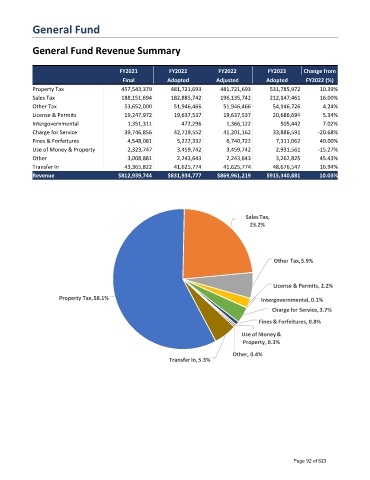

General Fund Revenue Summary

FY2021 FY2022 FY2022 FY2023 Change from

Final Adopted Adjusted Adopted FY2022 (%)

Property Tax 457,543,379 481,721,693 481,721,693 531,785,972 10.39%

Sales Tax 188,151,694 182,885,742 196,135,742 212,147,461 16.00%

Other Tax 53,652,000 51,946,466 51,946,466 54,146,726 4.24%

License & Permits 19,247,972 19,637,537 19,637,537 20,686,694 5.34%

Intergovernmental 1,351,311 472,296 1,366,122 505,442 7.02%

Charge for Service 39,746,856 42,719,552 41,201,162 33,886,591 -20.68%

Fines & Forfeitures 4,548,081 5,222,332 6,740,722 7,311,062 40.00%

Use of Money & Property 2,323,747 3,459,742 3,459,742 2,931,561 -15.27%

Other 3,008,881 2,243,643 2,243,643 3,262,825 45.43%

Transfer In 43,365,822 41,625,774 41,625,774 48,676,547 16.94%

Revenue $812,939,744 $831,934,777 $869,961,219 $915,340,881 10.03%

SalesTax,

23.2%

Other Tax,5.9%

License & Permits, 2.2%

Property Tax,58.1% Intergovernmental, 0.1%

Charge for Service,3.7%

Fines & Forfeitures, 0.8%

Use of Money&

Property, 0.3%

Other, 0.4%

TransferIn,5.3%

Page 92 of 623