Page 74 - FortWorthFY23AdoptedBudget

P. 74

Budget Highlights

Sales Tax

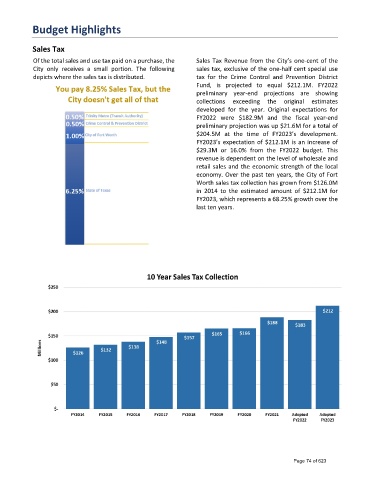

Of the total sales and use tax paid on a purchase, the Sales Tax Revenue from the City’s one-cent of the

City only receives a small portion. The following sales tax, exclusive of the one-half cent special use

depicts where the sales tax is distributed. tax for the Crime Control and Prevention District

Fund, is projected to equal $212.1M. FY2022

preliminary year-end projections are showing

collections exceeding the original estimates

developed for the year. Original expectations for

FY2022 were $182.9M and the fiscal year-end

preliminary projection was up $21.6M for a total of

$204.5M at the time of FY2023’s development.

FY2023’s expectation of $212.1M is an increase of

$29.3M or 16.0% from the FY2022 budget. This

revenue is dependent on the level of wholesale and

retail sales and the economic strength of the local

economy. Over the past ten years, the City of Fort

Worth sales tax collection has grown from $126.0M

in 2014 to the estimated amount of $212.1M for

FY2023, which represents a 68.25% growth over the

last ten years.

Page 74 of 623