Page 73 - FortWorthFY23AdoptedBudget

P. 73

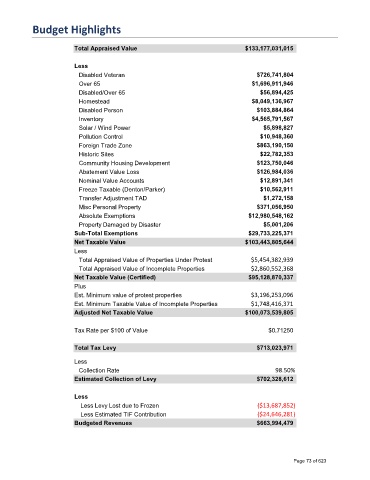

Budget Highlights

Total Appraised Value $133,177,031,015

Less

Disabled Veteran $726,741,804

Over 65 $1,696,911,946

Disabled/Over 65 $56,894,425

Homestead $8,049,136,967

Disabled Person $103,884,864

Inventory $4,565,791,567

Solar / Wind Power $5,898,827

Pollution Control $10,948,360

Foreign Trade Zone $863,190,150

Historic Sites $22,782,353

Community Housing Development $123,750,046

Abatement Value Loss $126,984,036

Nominal Value Accounts $12,891,341

Freeze Taxable (Denton/Parker) $10,562,911

Transfer Adjustment TAD $1,272,158

Misc Personal Property $371,056,950

Absolute Exemptions $12,980,548,162

Property Damaged by Disaster $5,001,206

Sub-Total Exemptions $29,733,225,371

Net Taxable Value $103,443,805,644

Less

Total Appraised Value of Properties Under Protest $5,454,382,939

Total Appraised Value of Incomplete Properties $2,860,552,368

Net Taxable Value (Certified) $95,128,870,337

Plus

Est. Minimum value of protest properties $3,196,253,096

Est. Minimum Taxable Value of Incomplete Properties $1,748,416,371

Adjusted Net Taxable Value $100,073,539,805

Tax Rate per $100 of Value $0.71250

Total Tax Levy $713,023,971

Less

Collection Rate 98.50%

Estimated Collection of Levy $702,328,612

Less

Less Levy Lost due to Frozen ($13,687,852)

Less Estimated TIF Contribution ($24,646,281)

Budgeted Revenues $663,994,479

Page 73 of 623