Page 315 - FortWorthFY23AdoptedBudget

P. 315

Fiduciary Funds

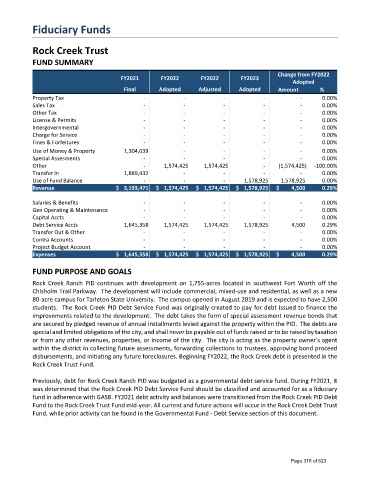

Rock Creek Trust

FUND SUMMARY

Change from FY2022

FY2021 FY2022 FY2022 FY2023

Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax - - - - - 0.00%

Sales Tax - - - - - 0.00%

Other Tax - - - - - 0.00%

License & Permits - - - - - 0.00%

Intergovernmental - - - - - 0.00%

Charge for Service - - - - - 0.00%

Fines & Forfeitures - - - - - 0.00%

Use of Money & Property 1,304,039 - - - - 0.00%

Special Assesments - - - - - 0.00%

Other - 1,574,425 1,574,425 - (1,574,425) -100.00%

Transfer In 1,889,432 - - - - 0.00%

Use of Fund Balance - - - 1,578,925 1,578,925 0.00%

Revenue $ 3,193,471 $ 1,574,425 $ 1,574,425 $ 1,578,925 $ 4,500 0.29%

Salaries & Benefits - - - - - 0.00%

Gen Operating & Maintenance - - - - - 0.00%

Capital Accts - - - - - 0.00%

Debt Service Accts 1,645,358 1,574,425 1,574,425 1,578,925 4,500 0.29%

Transfer Out & Other - - - - - 0.00%

Contra Accounts - - - - - 0.00%

Project Budget Account - - - - - 0.00%

Expenses $ 1,645,358 $ 1,574,425 $ 1,574,425 $ 1,578,925 $ 4,500 0.29%

FUND PURPOSE AND GOALS

Rock Creek Ranch PID continues with development on 1,755-acres located in southwest Fort Worth off the

Chisholm Trail Parkway. The development will include commercial, mixed-use and residential, as well as a new

80-acre campus for Tarleton State University. The campus opened in August 2019 and is expected to have 2,500

students. The Rock Creek PID Debt Service Fund was originally created to pay for debt issued to finance the

improvements related to the development. The debt takes the form of special assessment revenue bonds that

are secured by pledged revenue of annual installments levied against the property within the PID. The debts are

special and limited obligations of the city, and shall never be payable out of funds raised or to be raised by taxation

or from any other revenues, properties, or income of the city. The city is acting as the property owner's agent

within the district in collecting future assessments, forwarding collections to trustees, approving bond proceed

disbursements, and initiating any future foreclosures. Beginning FY2022, the Rock Creek debt is presented in the

Rock Creek Trust Fund.

Previously, debt for Rock Creek Ranch PID was budgeted as a governmental debt service fund. During FY2021, it

was determined that the Rock Creek PID Debt Service Fund should be classified and accounted for as a fiduciary

fund in adherence with GASB. FY2021 debt activity and balances were transitioned from the Rock Creek PID Debt

Fund to the Rock Creek Trust Fund mid-year. All current and future actions will occur in the Rock Creek Debt Trust

Fund, while prior activity can be found in the Governmental Fund - Debt Service section of this document.

Page 315 of 623