Page 531 - CityofColleyvilleFY23AdoptedBudget

P. 531

Trust Fund: In general, a fund for money donated or transferred to a municipality with speci c instructions on its use. As

custodian of trust funds, the treasurer invests and expends such funds as stipulated by trust agreements, as directed by the

commissioners of trust funds or by the community's legislative body. Both principal and interest may be used if the trust is

established as an expendable trust. For nonexpendable trust funds, only interest (not principal) may be expended as directed.

Uncollected Funds: Recently deposited checks included in an account’s balance but drawn on other banks and not yet

credited by the Federal Reserve Bank or local clearinghouse to the bank cashing the checks. (These funds may not be loaned

or used as part of the bank’s reserves and they are not available for disbursement.)

Undesignated Fund Balance: Monies in the various government funds as of the end of the scal year that are neither

encumbered nor reserved, and are therefore available for expenditure once certi ed as part of free cash.

Unreser ved Fund Balance (Surplus Revenue Account): The amount by which cash, accounts receivable, and other assets

exceed liabilities and restricted reserves. It is akin to a "stockholders’ equity" account on a corporate balance sheet. It is not,

however, available for appropriation in full because a portion of the assets listed as "accounts receivable" may be taxes

receivable and uncollected. (See Free Cash)

Valuation ( 100 Percent): The legal requirement that a community’s assessed value on property must re ect its market, or full

and fair cash value.

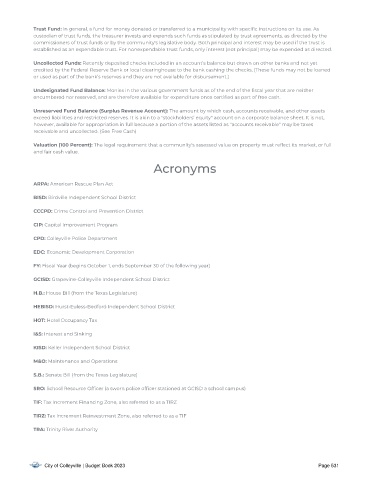

Acronyms

ARPA : American Rescue Plan Act

BISD: Birdville Independent School District

CCCPD: Crime Control and Prevention District

CIP: Capital Improvement Program

CPD: Colleyville Police Department

EDC: Economic Development Corporation

FY: Fiscal Year (begins October 1, ends September 30 of the following year)

GCISD: Grapevine-Colleyville Independent School District

H.B.: House Bill (from the Texas Legislature)

HEBISD: Hurst-Euless-Bedford Independent School District

HOT: Hotel Occupancy Tax

I&S: Interest and Sinking

KISD: Keller Independent School District

M&O: Maintenance and Operations

S .B.: Senate Bill (from the Texas Legislature)

SRO: School Resource Of cer (a sworn police of cer stationed at GCISD a school campus)

TIF: Tax Increment Financing Zone, also referred to as a TIRZ

TIRZ: Tax Increment Reinvestment Zone, also referred to as a TIF

TRA : Trinity River Authority

City of Colleyville | Budget Book 2023 Page 531