Page 530 - CityofColleyvilleFY23AdoptedBudget

P. 530

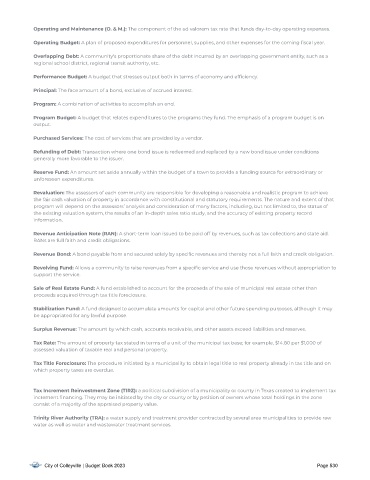

Operating and Maintenance (O. & M.): The component of the ad valorem tax rate that funds day-to-day operating expenses.

Operating Budget: A plan of proposed expenditures for personnel, supplies, and other expenses for the coming scal year.

Overlapping Debt: A community's proportionate share of the debt incurred by an overlapping government entity, such as a

regional school district, regional transit authority, etc.

Performance Budget: A budget that stresses output both in terms of economy and ef ciency.

Principal: The face amount of a bond, exclusive of accrued interest.

Program: A combination of activities to accomplish an end.

Program Budget: A budget that relates expenditures to the programs they fund. The emphasis of a program budget is on

output.

Purchased Ser vices: The cost of services that are provided by a vendor.

Refunding of Debt: Transaction where one bond issue is redeemed and replaced by a new bond issue under conditions

generally more favorable to the issuer.

Reser ve Fund: An amount set aside annually within the budget of a town to provide a funding source for extraordinary or

unforeseen expenditures.

Revaluation: The assessors of each community are responsible for developing a reasonable and realistic program to achieve

the fair cash valuation of property in accordance with constitutional and statutory requirements. The nature and extent of that

program will depend on the assessors’ analysis and consideration of many factors, including, but not limited to, the status of

the existing valuation system, the results of an in-depth sales ratio study, and the accuracy of existing property record

information.

Revenue Anticipation Note (RAN): A short-term loan issued to be paid off by revenues, such as tax collections and state aid.

RANs are full faith and credit obligations.

Revenue Bond: A bond payable from and secured solely by speci c revenues and thereby not a full faith and credit obligation.

Revolving Fund: Allows a community to raise revenues from a speci c service and use those revenues without appropriation to

support the service.

Sale of Real Estate Fund: A fund established to account for the proceeds of the sale of municipal real estate other than

proceeds acquired through tax title foreclosure.

Stabilization Fund: A fund designed to accumulate amounts for capital and other future spending purposes, although it may

be appropriated for any lawful purpose.

Surplus Revenue: The amount by which cash, accounts receivable, and other assets exceed liabilities and reserves.

Tax Rate: The amount of property tax stated in terms of a unit of the municipal tax base; for example, $14.80 per $1,000 of

assessed valuation of taxable real and personal property.

Tax Title Foreclosure: The procedure initiated by a municipality to obtain legal title to real property already in tax title and on

which property taxes are overdue.

Tax Increment Reinvestment Zone (TIRZ): a political subdivision of a municipality or county in Texas created to implement tax

increment nancing. They may be initiated by the city or county or by petition of owners whose total holdings in the zone

consist of a majority of the appraised property value.

Trinity River Authority (TRA): a water supply and treatment provider contracted by several area municipalities to provide raw

water as well as water and wastewater treatment services.

City of Colleyville | Budget Book 2023 Page 530