Page 16 - CityofColleyvilleFY23AdoptedBudget

P. 16

Small increase in property tax revenue due to new property developments only

Conservatively projected sales tax revenue, despite major gains in FY21/22

Lower budget for building permits due to the City approaching residential build-out

Lower budget for franchise fees due to the passing of House Bill 3535 by the Texas Legislature during the 84 th

session.

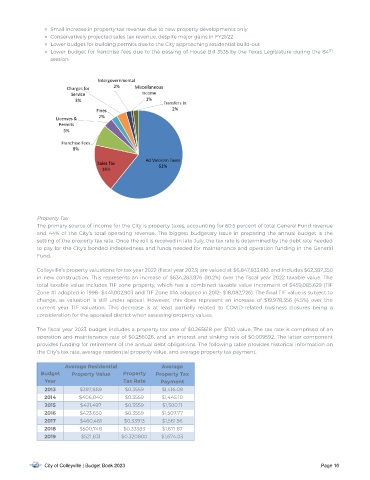

Property Tax

The primary source of income for the City is property taxes, accounting for 60.5 percent of total General Fund revenue

and 44% of the City’s total operating revenue. The biggest budgetary issue in preparing the annual budget is the

setting of the property tax rate. Once the roll is received in late July, the tax rate is determined by the debt rate needed

to pay for the City's bonded indebtedness and funds needed for maintenance and operation funding in the General

Fund.

Colleyville’s property valuations for tax year 2022 ( scal year 2023) are valued at $6,847,833,610, and includes $62,387,350

in new construction. This represents an increase of $634,283,876 (10.2%) over the scal year 2022 taxable value. The

total taxable value includes TIF zone property, which has a combined taxable value increment of $459,085,629 (TIF

Zone #1 adopted in 1998- $441,002,903 and TIF Zone #1A adopted in 2012- $18,082,726). The nal TIF value is subject to

change, as valuation is still under appeal. However, this does represent an increase of $19,978,356 (4.5%) over the

current year TIF valuation. This decrease is at least partially related to COVID-related business closures being a

consideration for the appraisal district when assessing property values.

The scal year 2023 budget includes a property tax rate of $0.265618 per $100 value. The tax rate is comprised of an

operation and maintenance rate of $0.256026, and an interest and sinking rate of $0.009592. The latter component

provides funding for retirement of the annual debt obligations. The following table provides historical information on

the City’s tax rate, average residential property value, and average property tax payment.

Average Residential Average

Budget Proper ty

Proper ty Value Proper ty Tax

Year Tax Rate

Payment

$397,889 $0.3559 $1,416.09

2013

$406,040 $0.3559 $1,445.10

2014

$421,497 $0.3559 $1,500.11

2015

$423,650 $0.3559 $1,507.77

2016

$460,461 $0.33913 $1,561.56

2017

$500,748 $0.33383 $1,671.67

2018

$521,831 $0.320800 $1,674.03

2019

City of Colleyville | Budget Book 2023 Page 16