Page 79 - Bedford-FY22-23 Budget

P. 79

Fund Balance

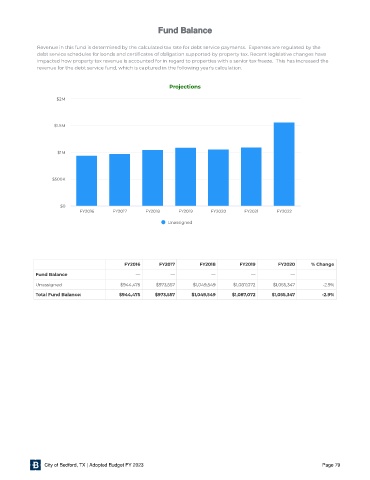

Revenue in this fund is determined by the calculated tax rate for debt service payments. Expenses are regulated by the

debt service schedules for bonds and certi cates of obligation supported by property tax. Recent legislative changes have

impacted how property tax revenue is accounted for in regard to properties with a senior tax freeze. This has increased the

revenue for the debt service fund, which is captured in the following year's calculation.

Projections

$2M

$1.5M

$1M

$500K

$0

FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022

Unassigned

FY2016 FY2017 FY2018 FY2019 FY2020 % Change

— — — — —

Fund Balance

Unassigned $944,475 $973,557 $1,049,549 $1,087,072 $1,055,347 -2.9%

Total Fund Balance: $944 ,475 $973,557 $1,049,549 $1,087,072 $1,055, 347 -2 .9%

City of Bedford, TX | Adopted Budget FY 2023 Page 79