Page 5 - Bedford-FY22-23 Budget

P. 5

Fiscal Year 2022-2023 Budget Cover Page

Pursuant to Senate Bill 656

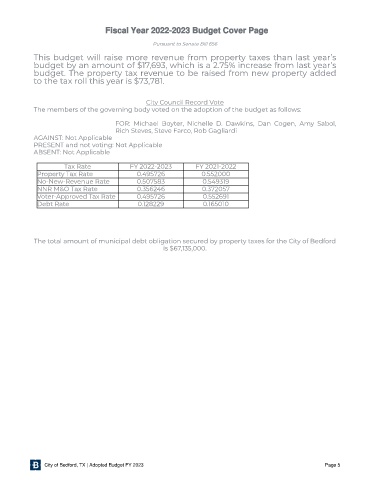

This budget will raise more revenue from property taxes than last year’s

budget by an amount of $17,693, which is a 2.75% increase from last year’s

budget. The property tax revenue to be raised from new property added

to the tax roll this year is $73,781.

City Council Record Vote

The members of the governing body voted on the adoption of the budget as follows:

FOR: Michael Boyter, Nichelle D. Dawkins, Dan Cogen, Amy Sabol,

Rich Steves, Steve Farco, Rob Gagliardi

AGAINST: Not Applicable

PRESENT and not voting: Not Applicable

ABSENT: Not Applicable

Tax Rate FY 2022-2023 FY 2021-2022

Property Tax Rate 0.495726 0.552000

No-New-Revenue Rate 0.507583 0.549319

NNR M&O Tax Rate 0.356246 0.372057

Voter-Approved Tax Rate 0.495726 0.552691

Debt Rate 0.128229 0.165010

The total amount of municipal debt obligation secured by property taxes for the City of Bedford

is $67,135,000.

City of Bedford, TX | Adopted Budget FY 2023 Page 5