Page 194 - PowerPoint Presentation

P. 194

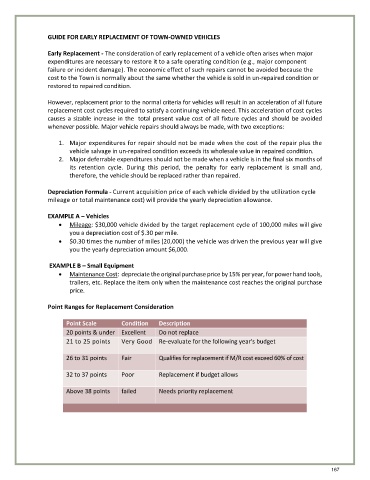

GUIDE FOR EARLY REPLACEMENT OF TOWN-OWNED VEHICLES

Early Replacement - The consideration of early replacement of a vehicle often arises when major

expenditures are necessary to restore it to a safe operating condition (e.g., major component

failure or incident damage). The economic effect of such repairs cannot be avoided because the

cost to the Town is normally about the same whether the vehicle is sold in un-repaired condition or

restored to repaired condition.

However, replacement prior to the normal criteria for vehicles will result in an acceleration of all future

replacement cost cycles required to satisfy a continuing vehicle need. This acceleration of cost cycles

causes a sizable increase in the total present value cost of all fixture cycles and should be avoided

whenever possible. Major vehicle repairs should always be made, with two exceptions:

1. Major expenditures for repair should not be made when the cost of the repair plus the

vehicle salvage in un-repaired condition exceeds its wholesale value in repaired condition.

2. Major deferrable expenditures should not be made when a vehicle is in the final six months of

its retention cycle. During this period, the penalty for early replacement is small and,

therefore, the vehicle should be replaced rather than repaired.

Depreciation Formula - Current acquisition price of each vehicle divided by the utilization cycle

mileage or total maintenance cost) will provide the yearly depreciation allowance.

EXAMPLE A – Vehicles

• Mileage: $30,000 vehicle divided by the target replacement cycle of 100,000 miles will give

you a depreciation cost of $.30 per mile.

• $0.30 times the number of miles (20,000) the vehicle was driven the previous year will give

you the yearly depreciation amount $6,000.

EXAMPLE B – Small Equipment

• Maintenance Cost: depreciate the original purchase price by 15% per year, for power hand tools,

trailers, etc. Replace the item only when the maintenance cost reaches the original purchase

price.

Point Ranges for Replacement Consideration

Point Scale Condition Description

20 points & under Excellent Do not replace

21 to 25 points Very Good Re-evaluate for the following year's budget

26 to 31 points Fair Qualifies for replacement if M/R cost exceed 60% of cost

32 to 37 points Poor Replacement if budget allows

Above 38 points failed Needs priority replacement

167