Page 17 - PowerPoint Presentation

P. 17

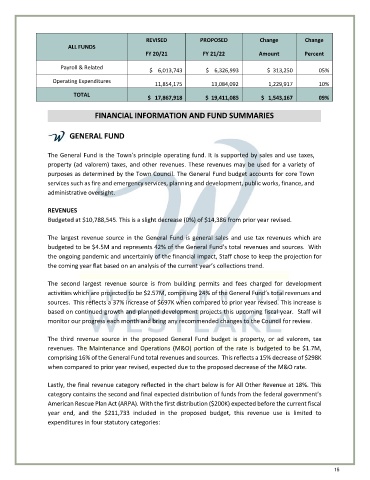

REVISED PROPOSED Change Change

ALL FUNDS

FY 20/21 FY 21/22 Amount Percent

Payroll & Related $ 6,013,743 $ 6,326,993 $ 313,250 05%

Operating Expenditures 11,854,175 13,084,092 1,229,917 10%

TOTAL $ 17,867,918 $ 19,411,085 $ 1,543,167 09%

FINANCIAL INFORMATION AND FUND SUMMARIES

GENERAL FUND

The General Fund is the Town’s principle operating fund. It is supported by sales and use taxes,

property (ad valorem) taxes, and other revenues. These revenues may be used for a variety of

purposes as determined by the Town Council. The General Fund budget accounts for core Town

services such as fire and emergency services, planning and development, public works, finance, and

administrative oversight.

REVENUES

Budgeted at $10,788,545. This is a slight decrease (0%) of $14,386 from prior year revised.

The largest revenue source in the General Fund is general sales and use tax revenues which are

budgeted to be $4.5M and represents 42% of the General Fund’s total revenues and sources. With

the ongoing pandemic and uncertainly of the financial impact, Staff chose to keep the projection for

the coming year flat based on an analysis of the current year’s collections trend.

The second largest revenue source is from building permits and fees charged for development

activities which are projected to be $2.57M, comprising 24% of the General Fund’s total revenues and

sources. This reflects a 37% increase of $697K when compared to prior year revised. This increase is

based on continued growth and planned development projects this upcoming fiscal year. Staff will

monitor our progress each month and bring any recommended changes to the Council for review.

The third revenue source in the proposed General Fund budget is property, or ad valorem, tax

revenues. The Maintenance and Operations (M&O) portion of the rate is budgeted to be $1.7M,

comprising 16% of the General Fund total revenues and sources. This reflects a 15% decrease of $298K

when compared to prior year revised, expected due to the proposed decrease of the M&O rate.

Lastly, the final revenue category reflected in the chart below is for All Other Revenue at 18%. This

category contains the second and final expected distribution of funds from the federal government’s

American Rescue Plan Act (ARPA). With the first distribution ($200K) expected before the current fiscal

year end, and the $211,733 included in the proposed budget, this revenue use is limited to

expenditures in four statutory categories:

15