Page 16 - PowerPoint Presentation

P. 16

The difference between the appraised value and the taxable value are the Town’s homestead and

other exemptions. The Town offers the following exemptions and property tax rate reduction

programs to our residents:

Homestead Exemption

Additional 65+ or Disabled Exemption

Additional Tax Ceiling, or Tax Freeze, for 65+ or Disabled

Property Tax Reduction, or Additional Sales & Use Tax

PROPOSED BUDGET – FY 2022

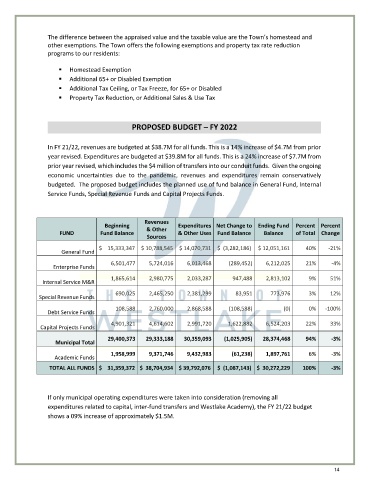

In FY 21/22, revenues are budgeted at $38.7M for all funds. This is a 14% increase of $4.7M from prior

year revised. Expenditures are budgeted at $39.8M for all funds. This is a 24% increase of $7.7M from

prior year revised, which includes the $4 million of transfers into our conduit funds. Given the ongoing

economic uncertainties due to the pandemic, revenues and expenditures remain conservatively

budgeted. The proposed budget includes the planned use of fund balance in General Fund, Internal

Service Funds, Special Revenue Funds and Capital Projects Funds.

Revenues

Beginning Expenditures Net Change to Ending Fund Percent Percent

FUND Fund Balance & Other & Other Uses Fund Balance Balance of Total Change

Sources

$ 15,333,347 $ 10,788,545 $ 14,070,731 $ (3,282,186) $ 12,051,161 40% -21%

General Fund

6,501,477 5,724,016 6,013,468 (289,452) 6,212,025 21% -4%

Enterprise Funds

1,865,614 2,980,775 2,033,287 947,488 2,813,102 9% 51%

Internal Service M&R

690,025 2,465,250 2,381,299 83,951 773,976 3% 12%

Special Revenue Funds

108,588 2,760,000 2,868,588 (108,588) (0) 0% -100%

Debt Service Funds

4,901,321 4,614,602 2,991,720 1,622,882 6,524,203 22% 33%

Capital Projects Funds

29,400,373 29,333,188 30,359,093 (1,025,905) 28,374,468 94% -3%

Municipal Total

1,958,999 9,371,746 9,432,983 (61,238) 1,897,761 6% -3%

Academic Funds

TOTAL ALL FUNDS $ 31,359,372 $ 38,704,934 $ 39,792,076 $ (1,087,143) $ 30,272,229 100% -3%

If only municipal operating expenditures were taken into consideration (removing all

expenditures related to capital, inter-fund transfers and Westlake Academy), the FY 21/22 budget

shows a 09% increase of approximately $1.5M.

14