Page 73 - Trophy Club FY22 Budget

P. 73

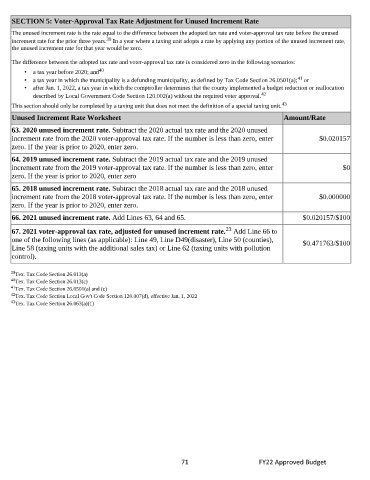

SECTION 5: Voter-Approval Tax Rate Adjustment for Unused Increment Rate

The unused increment rate is the rate equal to the difference between the adopted tax rate and voter-approval tax rate before the unused

39

increment rate for the prior three years. In a year where a taxing unit adopts a rate by applying any portion of the unused increment rate,

the unused increment rate for that year would be zero.

The difference between the adopted tax rate and voter-approval tax rate is considered zero in the following scenarios:

• a tax year before 2020; and 40

41

• a tax year in which the municipality is a defunding municipality, as defined by Tax Code Section 26.0501(a); or

• after Jan. 1, 2022, a tax year in which the comptroller determines that the county implemented a budget reduction or reallocation

described by Local Government Code Section 120.002(a) without the required voter approval. 42

This section should only be completed by a taxing unit that does not meet the definition of a special taxing unit. 43

Unused Increment Rate Worksheet Amount/Rate

63. 2020 unused increment rate. Subtract the 2020 actual tax rate and the 2020 unused

increment rate from the 2020 voter-approval tax rate. If the number is less than zero, enter $0.020157

zero. If the year is prior to 2020, enter zero.

64. 2019 unused increment rate. Subtract the 2019 actual tax rate and the 2019 unused

increment rate from the 2019 voter-approval tax rate. If the number is less than zero, enter $0

zero. If the year is prior to 2020, enter zero

65. 2018 unused increment rate. Subtract the 2018 actual tax rate and the 2018 unused

increment rate from the 2018 voter-approval tax rate. If the number is less than zero, enter $0.000000

zero. If the year is prior to 2020, enter zero.

66. 2021 unused increment rate. Add Lines 63, 64 and 65. $0.020157/$100

23

67. 2021 voter-approval tax rate, adjusted for unused increment rate. Add Line 66 to

one of the following lines (as applicable): Line 49, Line D49(disaster), Line 50 (counties), $0.471763/$100

Line 58 (taxing units with the additional sales tax) or Line 62 (taxing units with pollution

control).

39 Tex. Tax Code Section 26.013(a)

40 Tex. Tax Code Section 26.013(c)

41 Tex. Tax Code Section 26.0501(a) and (c)

42 Tex. Tax Code Section Local Gov't Code Section 120.007(d), effective Jan. 1, 2022

43 Tex. Tax Code Section 26.063(a)(1)

71 FY22 Approved Budget