Page 71 - Trophy Club FY22 Budget

P. 71

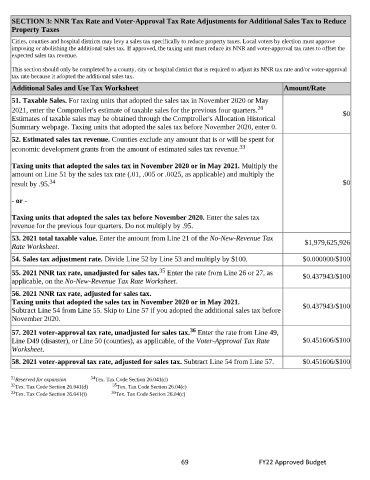

SECTION 3: NNR Tax Rate and Voter-Approval Tax Rate Adjustments for Additional Sales Tax to Reduce

Property Taxes

Cities, counties and hospital districts may levy a sales tax specifically to reduce property taxes. Local voters by election must approve

imposing or abolishing the additional sales tax. If approved, the taxing unit must reduce its NNR and voter-approval tax rates to offset the

expected sales tax revenue.

This section should only be completed by a county, city or hospital district that is required to adjust its NNR tax rate and/or voter-approval

tax rate because it adopted the additional sales tax.

Additional Sales and Use Tax Worksheet Amount/Rate

51. Taxable Sales. For taxing units that adopted the sales tax in November 2020 or May

2021, enter the Comptroller's estimate of taxable sales for the previous four quarters. 20 $0

Estimates of taxable sales may be obtained through the Comptroller's Allocation Historical

Summary webpage. Taxing units that adopted the sales tax before November 2020, enter 0.

52. Estimated sales tax revenue. Counties exclude any amount that is or will be spent for

33

economic development grants from the amount of estimated sales tax revenue.

Taxing units that adopted the sales tax in November 2020 or in May 2021. Multiply the

amount on Line 51 by the sales tax rate (.01, .005 or .0025, as applicable) and multiply the

result by .95. 34 $0

- or -

Taxing units that adopted the sales tax before November 2020. Enter the sales tax

revenue for the previous four quarters. Do not multiply by .95.

53. 2021 total taxable value. Enter the amount from Line 21 of the No-New-Revenue Tax $1,979,625,926

Rate Worksheet.

54. Sales tax adjustment rate. Divide Line 52 by Line 53 and multiply by $100. $0.000000/$100

35

55. 2021 NNR tax rate, unadjusted for sales tax. Enter the rate from Line 26 or 27, as $0.437943/$100

applicable, on the No-New-Revenue Tax Rate Worksheet.

56. 2021 NNR tax rate, adjusted for sales tax.

Taxing units that adopted the sales tax in November 2020 or in May 2021. $0.437943/$100

Subtract Line 54 from Line 55. Skip to Line 57 if you adopted the additional sales tax before

November 2020.

36

57. 2021 voter-approval tax rate, unadjusted for sales tax. Enter the rate from Line 49,

Line D49 (disaster), or Line 50 (counties), as applicable, of the Voter-Approval Tax Rate $0.451606/$100

Worksheet.

58. 2021 voter-approval tax rate, adjusted for sales tax. Subtract Line 54 from Line 57. $0.451606/$100

31 Reserved for expansion Tex. Tax Code Section 26.041(d)

34

35

32 Tex. Tax Code Section 26.041(d) Tex. Tax Code Section 26.04(c)

36

33 Tex. Tax Code Section 26.041(i) Tex. Tax Code Section 26.04(c)

69 FY22 Approved Budget